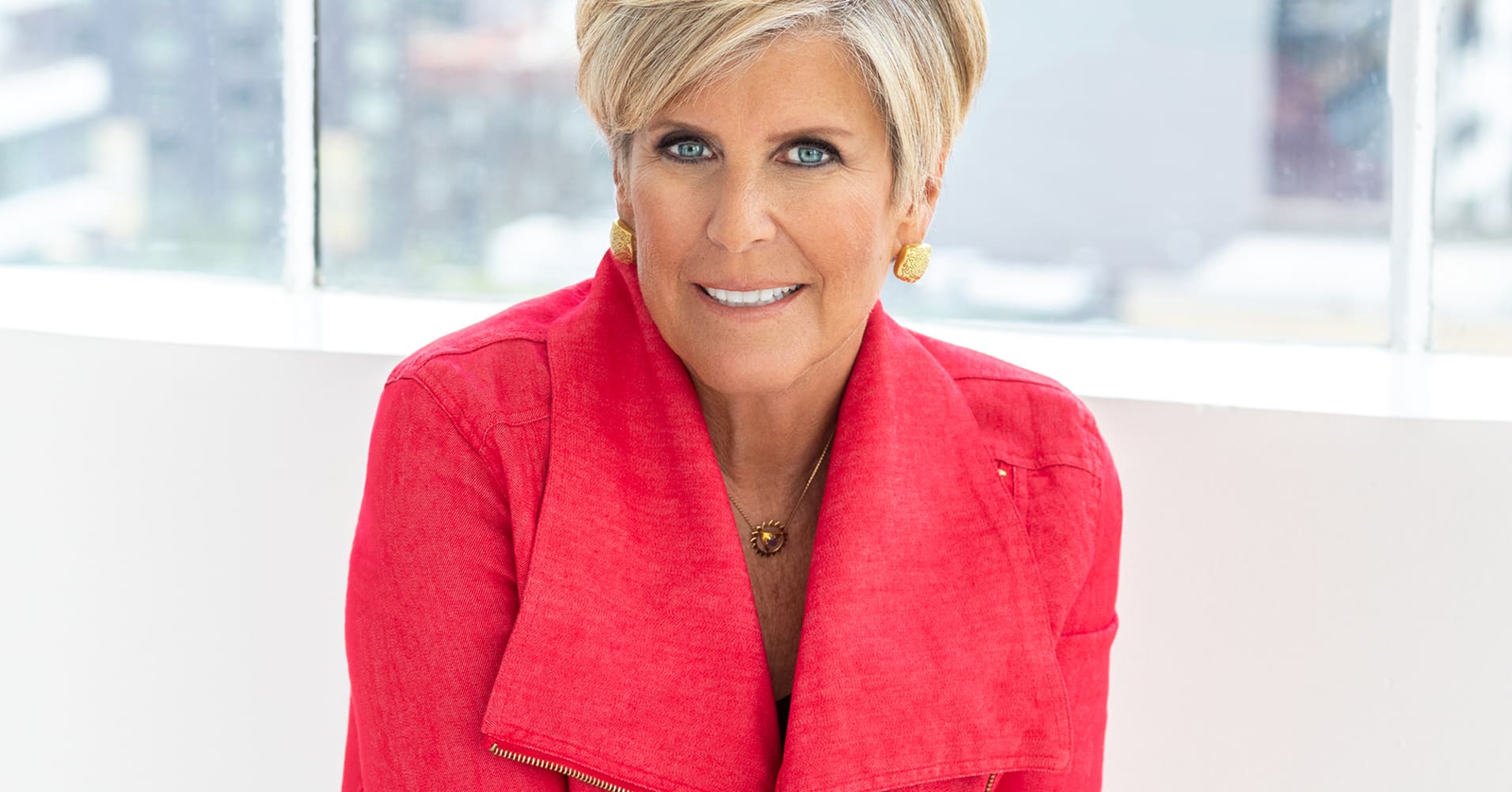

Suze Orman's Top Retirement Pick: "Only a Fool" Would Choose Anything Else—"Regardless of Your Tax Bracket"

When saving in a tax-advantaged retirement account, you typically have two main options to select from.

The decision hinges on whether you prefer taxes now or later with options like traditional 401(k)s and individual retirement accounts are financed using pretax money, which means you receive a tax reduction in the year you make your contributions. Roth accounts You initially pay taxes, yet you can make withdrawals without additional taxation at retirement, as long as you adhere to certain regulations.

The debate about choosing between different types of accounts usually centers on one’s income level. For early-career individuals with lower incomes, experts often recommend opting for a Roth IRA since saving on taxes at a lower rate now could be more beneficial than doing so later when retired earnings might place them in a higher bracket. Conversely, high-earning professionals are frequently advised to go for traditional accounts due to the immediate tax benefits these provide.

Nevertheless, certain financial experts believe you shouldn't concern yourself with that specific calculation.

"It doesn’t matter which tax bracket you fall into," he states. Suze Orman , a financial specialist and the host of the " Women & Money (and Anyone Wise Enough to Pay Attention) I heard on a podcast that you must be out of your mind to choose any retirement option over a Roth IRA.

Why certain specialists have a strong affinity for Rothschilds

Orman’s thoughts align with those of Ed Slott, a certified public accountant who founded IRAHelp.com and is among the foremost promoters of Roth accounts online.

Regarding the decision to pay your taxes sooner rather than later, almost everybody should opt to pay now for these two key reasons, he explains.

1. The Roths do not tax your earnings.

For investors using conventional accounts, the sum invested can be deducted from their taxable income during the same year as the contribution. However, this benefit comes with restrictions; typically, they cannot access these funds before retiring without facing penalties. Furthermore, upon withdrawal at retirement age, both the initial investments and any earnings accrued will be subject to income taxes.

Should the market rise throughout your investment career—as it generally has in the past—then each additional cent you accumulate will increase your future tax liability.

The construction of that tax is continuously underway. Previously, Slott informed https://5.180.24.3/Make It . "The values are up, but that means the eventual share that will be going to Uncle Sam will be higher, too."

On the other hand, Roths deduct taxes on your contributions when they go in. You are allowed to withdraw up to the total amount you've put in from a Roth anytime without facing penalties. Additionally, as long as you're at least 59½ years old and have had the account for a minimum of five years, all withdrawals from a Roth IRA or 401(k) will be free of taxes.

2. The Roths benefit from lower tax rates.

The conventional wisdom regarding traditional versus Roth retirement accounts centers on individual tax rates. Those with higher incomes benefit from paying taxes later, whereas those with lower incomes are better off paying taxes upfront.

However, what about the total tax rate? Ultimately, the government might increase taxes universally, which typically indicates poor prospects for those who delay.

Even though predicting future changes in tax rates over the next few decades is impossible, it’s important to recognize that current tax rates are nearly as low as they have ever been. This observation comes from Christine Benz, who serves as the director of personal finance and retirement planning atMorningstar and has authored “ How To Retire ."

The tax rates currently stand quite low when compared to historical standards," she states. "Therefore, the suggestion is that it would be advantageous to take advantage of these lower tax rates now.

Think carefully about your choices prior to making a decision.

However, Benz isn't entirely persuaded like Orman or Slott that Roth IRAs are the best choice for everybody without exception.

Firstly, if tax rates remain comparatively low, the conventional reasoning might still be relevant for certain retirees who are saving, she explains.

The approach varies depending on the family situation. For individuals with higher incomes, their tax rates during their most financially productive years might be at their highest throughout their life," she explains. "Therefore, if they can receive a reduction in taxes for their contributions, this could be the preferable option.

Certainly, it can be challenging to accurately assess your position within your career progression and retirement savings path, making it beneficial to seek professional advice for this choice.

"In this aspect, financial planning software, along with input from a certified financial planner, can significantly enhance the process by providing valuable insights into projections about your contributions, current savings, and anticipated tax rates during retirement," Benz states.

Moreover, Benz believes there isn't any drawback in having a combination of funds distributed between Roth and traditional accounts for those who have retired.

The idea of tax diversification resonates with her. Since predicting future changes in tax rates is uncertain, utilizing a mix seems beneficial, she explains. This approach allows for varying taxation on investment assets, much like how one would spread investments across different asset types, strategies, and market segments for better diversity.

In essence, following the guidance of Orman and Slott and allocating all your resources to Roth accounts might result in higher tax payments for you compared to being slightly more tactical with your strategy.

But as Slott enjoys remarking , you ultimately get quite a good fallback option for when you retire: "You'll have a 0% tax rate on your retirement withdrawals."

Looking to increase your earnings at work? Enroll in the latest online course from https://5.180.24.3/ Ways to Secure a Raise in Salary Skilled mentors will equip you with the expertise required to secure a higher salary. This includes guidance on preparation, boosting your self-assurance, knowing exactly what actions and statements to make, as well as techniques for formulating a counteroffer. Reserve your spot early by pre-registering today and apply the promo code EARLYBIRD to enjoy a half-price discount until November 26, 2024.

Plus, subscribe to https://5. 180. 24. 3/'s newsletter To acquire advice and strategies for achieving success at your job, managing finances, and navigating everyday life.

Comments

Post a Comment