10 Crucial Mistakes to Avoid When Purchasing a Home

Future Development

If you're considering a particular house, ponder over possible changes in the neighborhood. For instance: Should the property be close to a bustling street, could there be upcoming expansions? Or if the location has plenty of vacant land nearby, might new constructions pop up shortly?

Finding solid details regarding upcoming changes might be challenging, yet considering various scenarios as you search could assist you in locating your dream house. Additionally, remember to factor in possible contingencies. resale value Of your potential future residence since nobody can predict what lies ahead, and you might have to sell sooner than anticipated.

Forgetting Pre-Approval

If you're truly committed to purchasing a home rather than merely browsing, make certain to secure pre-approval from your bank or credit union PRIOR to beginning your property search. This step stands out as crucial advice many buyers regret overlooking when acquiring their first home. Additionally, aim for actual pre-approval over mere pre-qualification; the latter only provides an initial statement from your financial institution without involving comprehensive credit assessments and similar procedures.

Having pre-approval ensures that you'll be well-prepared to submit an offer once you find a suitable home, particularly in competitive markets. Additionally, it clarifies your budget limits, making it easier for you to focus your search accordingly.

Ignoring Old Paint

Despite the fact that sellers are required to fill out a lead-pair disclosure form in most states, if the home you’re considering was built before 1978, you should seriously consider its potential for lead-based paint. On one of your showings, take a lead-paint test kit with you to swab a few areas that seem suspicious (flaking, zebra-like chips). I

Skipping the Final Walk-Through

Many purchase contracts include provisions for a last inspection of the home to confirm that it remains in satisfactory condition. This provision is particularly important when buying a foreclosed property. Additionally, various incidents might cause damage during the period between signing the contract and closing the deal. move out Or repairmen might become negligent with any repairs requested at the time of purchase, so you'll want to make sure no new damages were inflicted last minute.

The Journey to Work Takes Too Much Time

There comes a moment when commuting turns into a chore. Should your daily travel be eating significantly into time with loved ones or pursuing individual aspirations, consider finding a residence nearer to your workplace. The effort could very well pay off. reduce to a more compact residence rather than spending excessive amounts of time away from work each day.

Roof Leaks

Home inspectors Many issues can go unnoticed when examining a house; even experienced professionals might miss some details consistently. It's common for most home inspectors not to venture onto the roof during their assessment. Therefore, it's crucial to have aspects that often get overlooked inspected by specialists instead. A leakage might indicate that your roof requires replacement—a costly undertaking indeed.

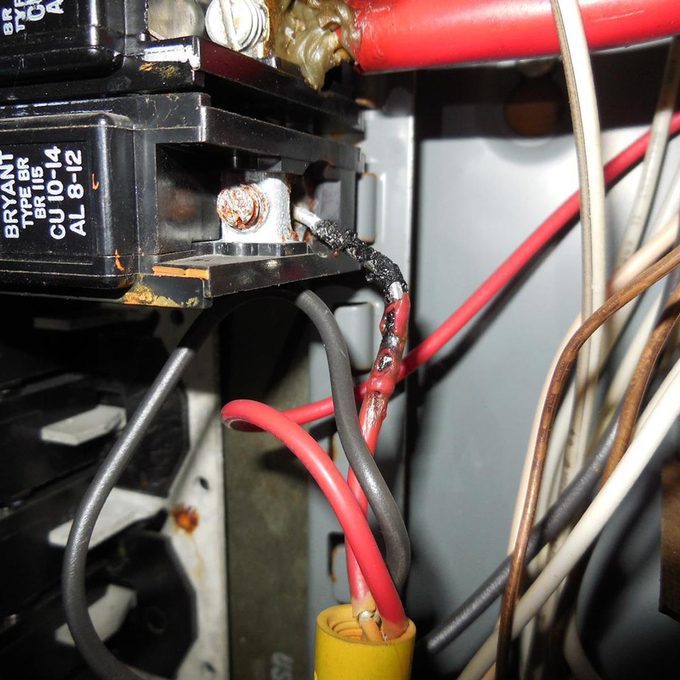

Inspect for Aged or Worn Electrical Wiring

Houses constructed during the mid-1960s or 1970s could potentially aluminum wiring And if this is the case, it needs to be checked whether all components have been retrofitted correctly. If they haven't, it might pose a fire risk, and replacing the wiring could cost several thousand dollars.

Not Saving Enough Money

A NerdWallet survey Of 2,200 homeowners and mortgage applicants surveyed, it was discovered that the primary remorse among millennials who bought homes was their desire to have set aside additional funds prior to purchasing a home Saving money is crucial for amassing an adequate down payment. Additionally, it’s essential to set aside some funds post-purchase to cover unexpected costs that may arise. According to the same survey, over ten percent of participants reported feeling less financially stable following their home purchase. Here’s what we think about this: How much time does one need to save up for a home? .

Not Doing Enough Research

There are lots of factors to keep in mind when purchasing a home . Nearly half of the respondents in the survey mentioned above said they’d do something different if they could. Near the top of the list of things they’d do better the second time was doing more research. A total of 41 percent of people who applied for a mortgage felt they weren’t aware of all of their loan options. Many first-time homebuyers aren’t aware of all of the costs associated with buying a house, especially the closing costs.

Wrong Size Home

Almost 20 percent of millennial purchasers and 20 percent of Generation X purchasers expressed remorse in the NerdWallet survey for not purchasing a larger home.

Comments

Post a Comment