This Tech Stock Could Be a Knockout Buy Post-Nasdaq Correction, Say Wall Street Pros

The tech-heavy Nasdaq-100 The index has dropped over 10% from its peak last month, though it had fallen as much as 13% during early March. The U.S. stock market experienced widespread selling due to historically high valuations combined with growing concerns and uncertainties regarding tariffs, potential trade conflicts, and broader economic conditions, leading many investors to adopt a cautious stance towards risk.

However, traditionally, the U.S. stock market has invariably rebounded from its declines to reach even higher peaks, making corrections generally excellent times for purchasing. Numerous top-tier stocks experienced significant drops over the past few weeks — including some of these: Netflix (NASDAQ: NFLX) , which had dropped by up to 18% from its highest point, and currently trades around 8% lower than that peak.

Where should you put your $1,000 investment at this moment? Our analysis team has just disclosed what they consider to be the 10 best stocks to buy right now. Learn More »

Netflix began to bounce back, yet investors could still purchase its shares at a reduced price. According to analysts on Wall Street, this may prove to be a wise decision. The Wall Street Journal There are 54 analysts tracking the Netflix stock, and most of them have given it the strongest 'buy' recommendation, with not a single one rating it as a 'sell'.

Netflix emerged victorious in the streaming wars.

Earlier this month, in a communication to their clientele, the Wall Street research company MoffettNathanson stated, "Netflix has claimed victory as the streaming "Wars. Case closed." At the same time, they increased their price target for the stock from $900 to $1,150. The firm could be correct — Netflix concluded 2024 with 301.6 million paid subscribers, leaving competitors far behind. Amazon 'Amazon Plus, boasting around 200 million customers (Amazon does not distinguish between Prime members and Prime Video viewers), or Disney Disney+, which boasts 124.6 million subscribers, is what they're referring to.

That enormous scale transformed Netflix into a money-making powerhouse, distinguishing it significantly from most rival platforms, many of which still haven’t achieved steady profits. Netflix reported an all-time high of $8.7 billion. net income Last year saw a 61% rise compared to its 2023 figure. This was achieved with revenues of $39 billion. revenue , setting a new record as well.

Netflix's recent growth began when they tightened their rules on password sharing a few years back, but it picked up speed following the launch of an ad-supported lower-priced plan in November 2022. This new option costs $7.99 monthly, which is significantly less expensive compared to their standard tier priced at $17.99 and their premium tier costing $24.99 each month.

During the last quarter, the ad-supported subscription level made up 55% of total new subscriptions across the regions where it’s offered. This underscores its pivotal role in driving Netflix's expansion. Although these subscriber fees are lower, they have the potential to increase in value for the firm as the business model gains traction. With an influx of viewers who watch advertisements, more companies may be inclined to buy advertising space on Netflix. Over time, this could enable the platform to raise advertisement rates, thereby enhancing earnings per user.

Actually, Netflix reported that its ad revenue increased twofold in 2024, with company leaders anticipating another doubling of these earnings for the current year.

Live programming might ignite its subsequent stage of expansion.

Another major advantage of Netflix’s size is its ability to surpass its rivals in producing and acquiring content due to greater financial resources. This year, the firm intends to allocate approximately $18 billion towards new projects, with an emphasis on live programming following multiple successful broadcasts in the previous year.

There was The Roasting of Tom Brady In May, this was succeeded by the Mike Tyson versus Jake Paul boxing match in November, setting a record as the most-watched live streaming sports event at that time. Netflix broadcast two Christmas Day NFL games, drawing in 30 million and 31 million viewers respectively. These figures marked them as the most-streamed games ever in the league’s history.

The significance of live events can be understood through this insight: According to Netflix, an average user dedicates roughly 120 minutes per day to the service. However, considering that a typical NFL match lasts more than three hours, watching such an event from beginning to end would result in higher-than-normal interaction with the content. This high level of involvement is crucial as the firm aims to draw advertisers, who prefer placing their promotions on channels where audiences spend considerable amounts of time.

Netflix is poised for its most successful year ever in terms of live entertainment. They have secured a decade-long agreement with World Wrestling Entertainment (WWE), making the streaming service their exclusive home. TKO Group . Netflix is streaming WWE Raw experience each week globally, as well as Smackdown and NXT experience each week abroad, excluding the U.S. Additionally, the website will broadcast live special events as well. WrestleMania and SummerSlam for viewers abroad (within the U.S., Comcast Peacock will broadcast WWE's top-tier events).

Netflix shares could appear inexpensive considering their prospective value.

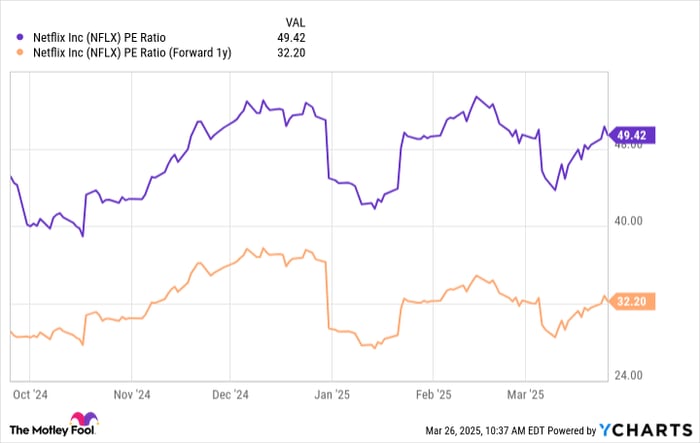

Netflix generated $19.83 in earnings per share (Earnings Per Share) for 2024 position its stock accordingly. price-to-earnings (P/E) ratio Of 49. This price point is quite steep compared to the Nasdaq-100 — where many of the company’s major tech rivals are listed — trading with a P/E ratio of only 29.

Nevertheless, Netflix is expanding rapidly enough that its future valuation does not seem excessively high. For example, according to Yahoo! Finance compilation of Wall Street’s consensus forecast, the firm is expected to produce $30.28 in earnings per share (EPS) for 2026, which positions its stock accordingly. forward P/E ratio of just 32.

This could explain why Wall Street continues to remain highly optimistic about Netflix's stock. Among the 54 analysts monitored by The Wall Street Journal , 32 have given it their top purchase recommendation. Another six classify it as overweight (optimistic), whereas 14 suggest holding. Though two analysts have marked it with an underweight (pessimistic) rating, none advise selling.

Their average forecasted price of $1,086 indicates an estimated increase of about 11% within the coming 12 to 18 months; however, the highest projected estimate from analysts at $1,494 points towards a possible surge of up to 53%.

Netflix believes it has secured just 6% of its potential $650 billion global market, which encompasses subscriptions, advertisements, gaming, and additional services. This indicates that even though Netflix leads the streaming sector, significant opportunities remain for expansion. Consequently, this makes the company’s shares potentially attractive for long-term investment, particularly since they're currently being traded at about 8% below their peak from the previous month.

Is investing $1,000 in Netflix at this moment a good idea?

Before purchasing stocks in Netflix, keep this in mind:

The Motley Fool Stock Advisor The analyst team has recently pinpointed what they think could be the 10 best stocks For investors looking to purchase now... Netflix was not among them. The 10 stocks selected could potentially yield enormous gains over the next few years.

Consider when Nvidia created this list on April 15, 2005... should you have invested $1,000 following our suggestion, you’d have $697,245 !*

Now, it’s worth noting Stock Advisor 's overall average return is 845% — significantly surpassing the market with exceptional performance compared to 165% For the S&P 500. Don’t miss out on the updated top 10 list, which becomes accessible upon joining. Stock Advisor .

Check out the 10 stocks here »

*Stock Advisor returns as of March 24, 2025

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Anthony Di Pizio does not hold any shares in the companies listed above. However, The Motley Fool holds stakes in and endorses Amazon, Netflix, and Walt Disney. Additionally, they recommend investing in Comcast and TKO Group Holdings. Furthermore, The Motley Fool owns shares in . disclosure policy .

Comments

Post a Comment