Unlock Lifetime Passive Income with These 3 Vanguard ETFs

Creating passive income forms the bedrock of achieving financial freedom. This approach yields consistent monetary inflows with minimal direct management, enabling individuals to concentrate on various life endeavors or seize further prospects. To numerous people, the pinnacle aspiration is establishing an investment collection that provides sufficient passive earnings for ongoing daily costs.

Introducing Vanguard exchange-traded funds (ETFs), the creation of an investment icon. John Bogle These exchange-traded funds provide an impressive mix of extensive diversification and minimal expenses, which makes them perfect tools for building long-term wealth and generating income. Vanguard’s investment philosophy, developed by Bogle, focuses on cost-effective, passive methods that have dramatically transformed the financial industry.

Read More: Earn up to $845 cash back this year just by changing how you pay at Costco! Learn more here.

Vanguard ETFs stand out in the financial world due to a distinctive combination of attributes. Generally, these funds exhibit lower turnover ratios than those found in actively managed options, which significantly cuts down on taxes for investors. The resulting tax efficiency, along with strong dividend growth rates observed across numerous Vanguard ETFs from their start, highlights the superior caliber of assets they hold beneath them.

Furthermore, Vanguard’s strategy for managing passively structured funds guarantees that these exchange-traded products mirror their respective benchmarks accurately. By employing this method, they enhance operational efficiency without sacrificing user-friendly simplicity preferred by retail investors. Consequently, this yields an effective financial tool that merges extensive market coverage with the affordability found in index-based strategies.

A key strength of Vanguard’s cost-effective exchange-traded funds (ETFs) lies in their dependability. Owing to well-diversified investment baskets and top-notch assets, these ETFs have a lower chance of halting payouts even when the economy falters. Such steadfastness offers considerable advantages compared to single stocks that might reduce or stop dividend payments during tough periods.

We'll delve into three Vanguard exchange-traded funds (ETFs) that could deliver lifelong passive income, with each presenting a distinct strategy for earning dividends.

A low-cost core holding

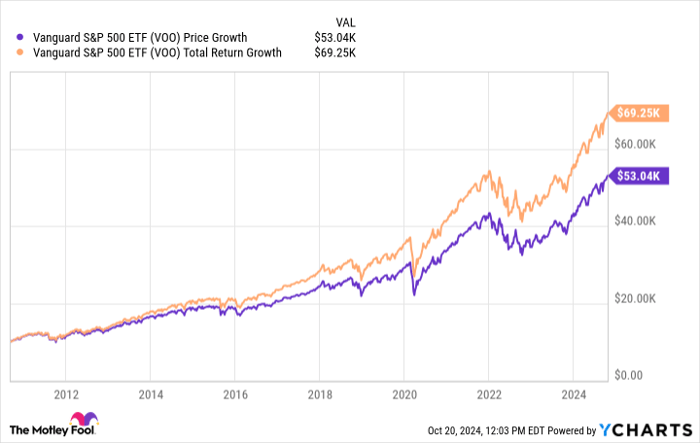

The Vanguard S&P 500 ETF (NYSEMKT: VOO) reflects the returns of the benchmark S&P 500 Index, which includes 500 of the biggest corporations in the U.S., boasts an exceptionally low expense ratio of 0.03%. This ETF helps investors keep more of what they earn. Although its 30-day SEC yield of 1.23% may seem relatively small at first glance, the real value comes from its strong prospects for future growth.

Since its launch in 2010, the fund has seen an impressive compound annual growth rate of 13.4%. CAGR This impressive chart demonstrates the effectiveness of putting money into top-tier, dividend-increasing stocks over an extended period. For instance, a $10,000 initial investment when the fund started, with all dividends being reinvested and disregarding taxes, has expanded to approximately $69,250 as of now.

Comprehensive U.S. market exposure

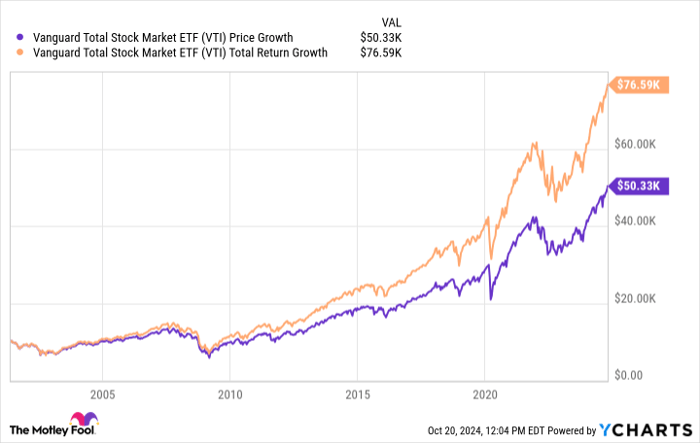

The Vanguard Total Stock Market Index Fund ETF Shares (NYSEMKT: VTI) provides investors with extensive access to the complete U.S. equity market, including small-, mid-, and large-capitalization stocks. Similar to its S&P 500 equivalent, it features an impressively low expense ratio of 0.03%, thus optimizing returns for investors.

While its 30-day SEC yield of 1.22% closely mirrors the S&P 500 ETF, this fund's true value lies in its long-term performance and diversification across the entire U.S. market. Since its inception in 2001, the fund's distributions have grown at an annual rate of 5.05%.

This consistent expansion leads to substantial gains over an extended period. An initial investment of $10,000 when the fund started, with dividends being continually reinvested and under the assumption of zero tax implications, has grown to approximately $76,590 as of now.

The fund’s performance has exceeded that of the mentioned S&P 500 ETF because of its more extensive history. It offers investors an easy method to achieve broad exposure to the complete U.S. equity market through one investment vehicle.

Focus on high-yield stocks

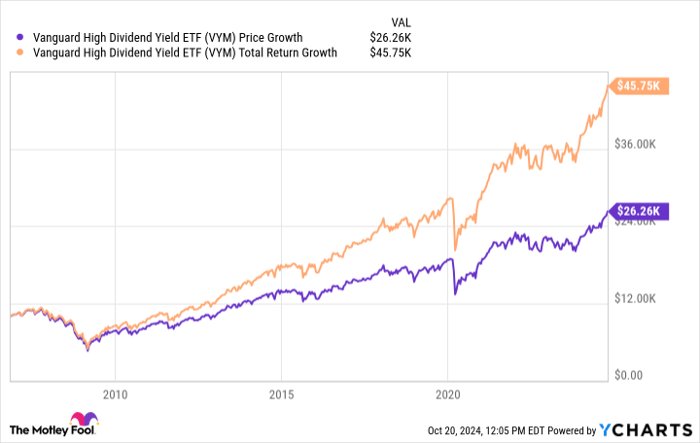

For investors focusing on generating immediate income, the Vanguard High-Dividend Yield Index Fund ETF Shares (NYSEMKT: VYM) offers an attractive choice. This exchange-traded fund focuses on equities known for their high dividend payouts, leading to a substantial 30-day SEC yield of 2.65%.

Although its expense ratio is somewhat higher at 0.06%, it still stands out as notably low when contrasted with actively managed funds. The fund excels particularly in producing income and showcasing growth prospects.

Since launching in 2006, this ETF has seen its payouts increase each year by an average of 9.18%. Despite having a slower earnings growth rate of 10.6%, which is below that of many broad-market ETFs, it makes up for it with a more substantial current yield.

To demonstrate its effectiveness, an initial investment of $10,000 since the inception of the fund, including dividend reinvestment and excluding taxes, has expanded to approximately $45,750 currently. This expansion highlights the fund’s capability for generating both revenue and increased asset value over periods of time.

The strength of hands-off management

Each of the three ETFs profits from Vanguard’s passive management strategy, ensuring they closely mirror their corresponding indices. This minimal intervention method streamlines investment for those looking for passive revenue. These ETFs boast low turnover rates—2.2% for both the Vanguard S&P 500 ETF and the Vanguard Total Stock Market ETF, and 5.7% for the Vanguard High Dividend Yield ETF—which boosts their overall tax effectiveness.

These Vanguard exchange-traded funds highlight the possibility of building increasing passive income gradually. They stand out in the ETF world due to their extensive diversification, very low costs, and hands-off management style.

Where should you put your $1,000 investment at this moment?

Whenever our analysis team suggests a stock pick, it’s worth paying attention. After all, Stock Advisor’s The overall average return stands at 820%, which significantly surpasses the S&P 500’s performance of 172%. *

They have just disclosed what they think are the 10 best stocks For investors looking to purchase at this moment...

Check out the 10 stocks here »

*Stock Advisor returns updated as of October 14, 2024

George Budwell holds stakes in the Vanguard S&P 500 ETF. The Motley Fool has investments in and endorses the Vanguard S&P 500 ETF, the Vanguard Total Stock Market ETF, as well as the Vanguard Whitehall Funds-Vanguard High Dividend Yield ETF. The Motley Fool possesses a disclosure policy .

Comments

Post a Comment