2 Dividend Stocks Poised to Thrive: Perfect Picks for Lifelong Passive Income

Stocks have not had a good performance this year because of various reasons. At the forefront of these reasons are macroeconomic tensions. Nevertheless, several businesses are thriving despite the instability, such as AbbVie (NYSE: ABBV) and Abbott Laboratories (NYSE: ABT) These two healthcare frontrunners might or might not keep outperforming the market in the coming weeks — predicting the trajectory of an individual stock or the overall equity markets over such a brief timeframe is particularly difficult.

Nevertheless, regardless of short-term developments, both AbbVie and Abbott Laboratories stand out as top choices for investors prioritizing dividends over the long haul. Here’s the reasoning behind this recommendation.

Where should you put your $1,000 investment at this moment? Our analysis team has just disclosed their thoughts on what they consider to be the 10 best stocks to buy right now. Learn More »

1. AbbVie

AbbVie's shares dropped off a cliff In November, following the announcement of a clinical setback for emraclidine—a drug being developed as a potential treatment for schizophrenia that was part of an $8.7 billion acquisition—the investors grew concerned. It’s reasonable to understand their worry since they might feel the company has invested almost $9 billion without success.

Nevertheless, AbbVie’s stock price has surged since experiencing a downturn, sustaining this upward trend all the way into 2025—albeit with some variability as of yet. While the development issues surrounding emraclidine were indeed troubling, they did not justify such a substantial decline in the share value. Despite having lost exclusive rights to what had once been one of their biggest moneymakers, Humira, roughly two years prior, the firm continues to post robust financial outcomes.

In 2024, AbbVie reported revenues totaling $56.3 billion, marking an increase of 3.7% compared to the previous year. While this figure falls slightly short of what would be deemed robust top-line expansion for such a large pharma company, it remains quite commendable given that they're navigating through the relatively recent expiration of their Humira patents. The firm’s portfolio includes highly effective drugs like Skyrizi and Rinvoq in immunology treatments, along with Botox—products where competition from biosimilar versions seems improbable based on past managerial statements—and more recently launched medications including headache therapy Qulipta.

Clinical setbacks and patent expirations are inevitable, yet AbbVie appears well-prepared to tackle these challenges. With numerous projects underway, the firm’s research portfolio is robust. Recently, AbbVie entered into an agreement with Gubra A/S, a Danish biotech entity, aimed at advancing experimental treatments for weight management—a sector that has seen significant growth lately. While AbbVie’s initiatives in this domain could either flourish or falter, their comprehensive pipeline suggests promising outcomes ahead. blockbusters To substitute its present medications, which continue to propel revenue growth.

Lastly, AbbVie is a Dividend King When we consider the period during which it was part of Abbott Laboratories — it boasts an impressive run of 53 uninterrupted years of dividend hikes. After separating from Abbott, AbbVie has boosted its dividends by 310%. Currently, the stock presents a forward yield of 3.1%, significantly higher than most options available. S&P 500 The index’s average remains at 1.3%. Regardless of how AbbVie's shares perform for the rest of this year, the company stands out as a robust choice for a long-term dividend investment.

2. Abbott Laboratories

Abbott Laboratories is a healthcare company This organization functions within the realms of medical devices, nutrition products, pharmaceuticals, and diagnostics. It stands as a frontrunner in multiple sectors it engages with. Among its renowned offerings is the infant formula line called Similac. Throughout the peak of the pandemic, Abbott Laboratories provided leading COVID-19 diagnostic testing solutions. In terms of its medical device division, Abbott’s flagship product, the FreeStyle Libre—a continuous glucose monitoring system—stands out as the highest-selling device in history for this category.

Nothing occurs randomly here. Over several decades, Abbott Laboratories has cultivated an environment that encourages creativity and invention. They have established considerable presence and accumulated extensive experience in tackling the complex and tightly controlled world of health care. While Abbott Laboratories seldom astounds shareholders with exponential income growth, consistent and predictable fiscal outcomes remain assured from the corporation. This scenario aligns well with their performance history over extended periods.

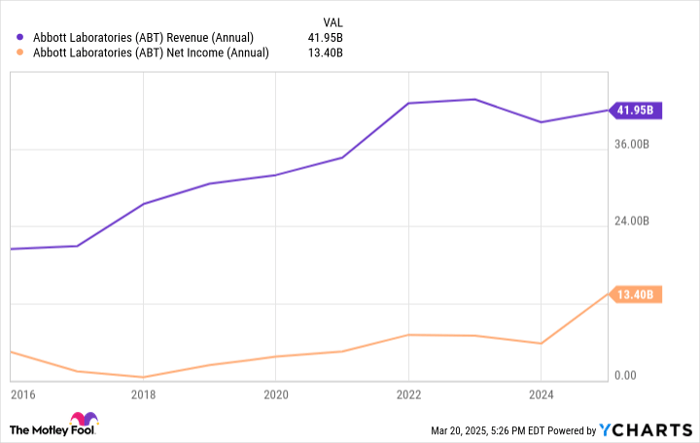

ABT Revenue (Annual) data by YCharts

Abbott Laboratories ought to benefit from sustained favorable trends allowing them to maintain their current trajectory. Their product, FreeStyle Libre, stands out as the primary engine for this growth; however, it remains vastly underutilized since less than 1% of global adults with diabetes utilized Continuous Glucose Monitoring (CGM) technology up until last year. Additionally, Abbott’s portfolio includes various advanced devices aimed at treating conditions like structural heart issues and heart failure—products which can expect growing demand due to an increasingly older populace around the globe.

Over the long term, Abbott Laboratories is expected to provide strong returns while increasing dividends each year, maintaining this practice consistently over the last 53 consecutive years. Although Abbott’s projected dividend yield stands at 1.9%, which may seem modest, the company’s solid fundamentals, promising future opportunities, and proven history indicate that it is a top choice for those seeking reliable investments with minimal oversight.

Is investing $1,000 in AbbVie at this moment a good idea?

Before purchasing shares in AbbVie, keep this in mind:

The Motley Fool Stock Advisor The analyst team has just pinpointed what they think could be the 10 best stocks For investors looking to purchase now... AbbVie was not among them. The selection of 10 stocks that were chosen have the potential to generate significant gains over the next few years.

Consider when Nvidia created this list on April 15, 2005... should you have invested $1,000 following our suggestion, you’d have $744,133 !*

Now, it’s worth noting Stock Advisor 'S total average return is 859%, which significantly surpasses the market performance. 167% For the S&P 500. Don’t miss out on the updated top 10 list, which becomes accessible upon joining. Stock Advisor .

Check out the 10 stocks here »

*Stock Advisor returns as of March 24, 2025

Prosper Junior Bakiny does not hold any shares in the companies listed above. However, The Motley Fool has investments in and endorses AbbVie and Abbott Laboratories. Additionally, The Motley Fool holds a disclosure policy .

Comments

Post a Comment