Macron Sees Opportunity: Euro Poised to Challenge the Dollar Amid Trump Turmoil

(GudangMovies21) -- Donald Trump has sparked European leaders' curiosity regarding currency markets.

After the euro jumped against the dollar, French president Emmanuel Macron quizzed central bank chief Christine Lagarde on the outlook for the exchange rate in private conversations in Brussels last week, according to people briefed on the discussions. Lagarde had been trying to persuade European Union leaders that Trump’s return offers opportunities to the bloc, the people said.

As the U.S. president discards his country’s economic strategy—causing global market disruptions—a few members of Europe’s policy-making class see an opening for boosting the region’s shared currency.

We shouldn't retreat; the euro has proven highly successful over the past 25 years," stated Bundesbank President Joachim Nagel during his recent trip to Paris. "Ultimately, should we become more competitive, the euro stands to gain significantly as a reserve currency.

This month, Germany abandoned years of careful financial management to provide assistance. revive its economy And reconstruct its armed forces, leading to a significant reassessment of European assets, with leaders now challenging other longstanding prohibitions that have hindered the EU’s progress.

The French leader, who previously worked as an investment banker, has taken the chance to advocate for his idea of Europe becoming a genuinely independent geopolitical power.

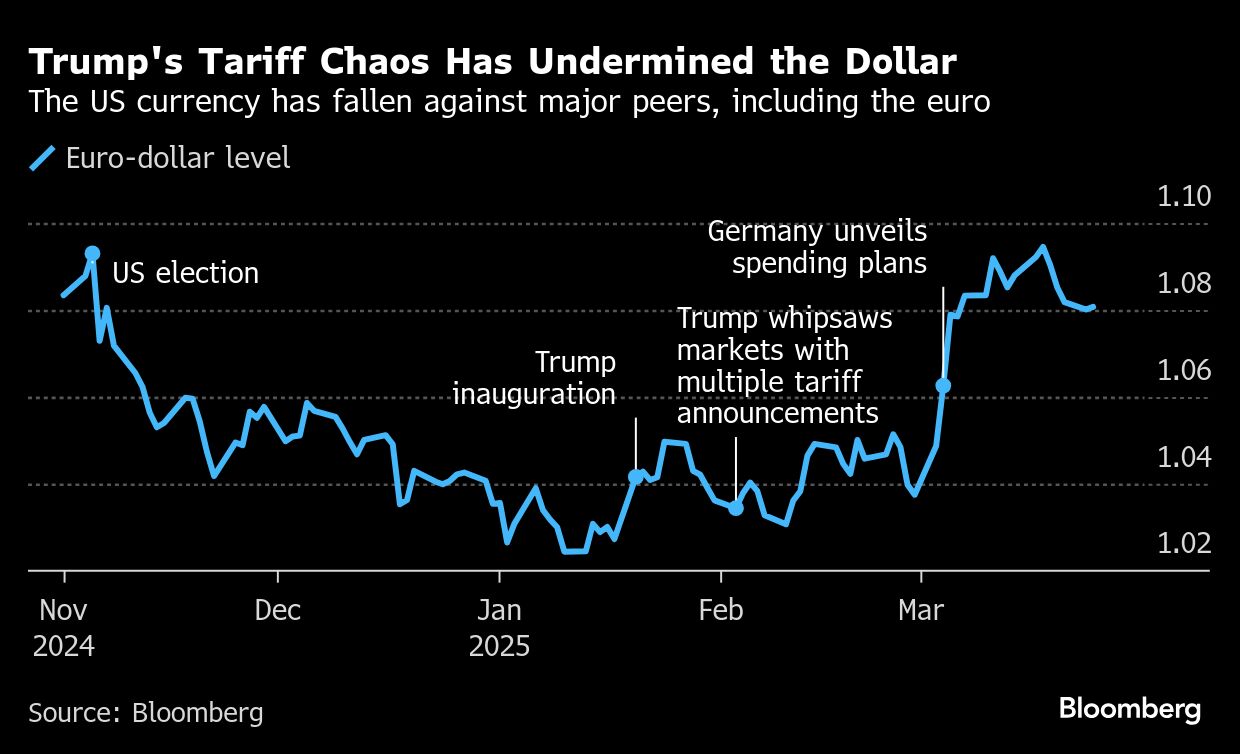

The door is opening as Trump shakes the foundations of the dollar as the world’s global currency. He’s upending commerce with tariffs and verbal attacks on both friends and foes, weakening commitments to NATO, and advisors have talked of a so-called Mar-a-Lago Accord That has the potential to reshuffle the global financial system.

He’s also pursuing tax cuts That might exacerbate budget deficits further. This week, the Congressional Budget Office cautioned that the U.S. could face this issue. set to start as early as August in the absence of an agreement to increase the debt limit.

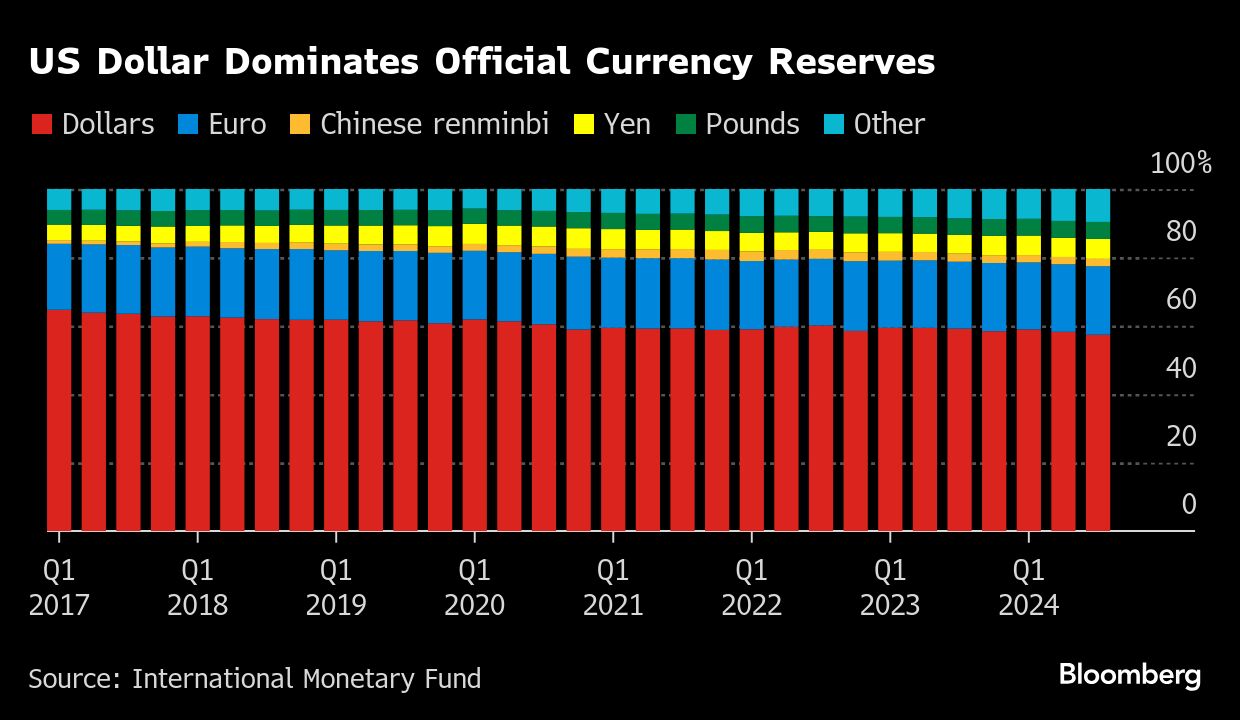

However, a significant change where global reserves move from dollars to euros is a concept that would take an extremely long time, if it's feasible at all. Previous instances of speculations predicting the decline of the US dollar have consistently been proven incorrect.

Recent data indicates that the euro accounts for just 20% of global foreign reserves, whereas the dollar comprises nearly 60%, a predominance that hasn’t changed much historically.

Even though the Trump administration’s antagonism encourages EU officials to make considerable progress, attempts to finalize the EU single market through a comprehensive banking union and a fully integrated capital markets union have faced delays for several years now.

Authorities in Berlin continue to rule out further collective EU bond issuances, which could otherwise enhance the euro's attractiveness to investors. However, they admit that this discussion is gaining traction, as noted by someone familiar with their perspective.

During the meeting in Brussels, Paschal Donohoe, who leads the group of eurozone finance ministers, mentioned that there is significant potential for the future if the European Union can enhance market efficiency. According to individuals familiar with their discussions, he highlighted this point. Christine Lagarde informed the leaders that the U.S.'s position as a safe refuge might be compromised due to President Trump's policy choices. The European Central Bank chose not to provide comments on the details of these exchanges.

If authorities manage to advance the integration of EU capital markets, they could potentially draw more investments from individuals looking for alternatives to assets denominated in dollars, she noted.

The idea of the euro filling any gap is enticing for Europe’s economy, businesses, and families. The dollar’s so-called “ exorbitant privilege generates demand for U.S. debt, which means larger, more liquid markets that facilitate easier and less expensive funding.

As a currency becomes more significant globally, policymakers gain greater independence to establish fiscal and monetary strategies best suited for their nation’s economic needs, with reduced concern over exchange rate fluctuations impacting inflation. Additionally, this prominence has provided U.S. banks an advantage in international market competition and granted the country increased influence in shaping and enforcing the regulations governing worldwide capitalism through various international bodies.

"There are several benefits that are not only economic but also geopolitical," he stated. Jens van ‘t Klooster , a political economist at the University of Amsterdam. "We haven't reached that point yet, that much is evident, but people often underestimate how swiftly such changes can occur, as evidenced by the fact that it took a hundred years for the British Pound Sterling to be supplanted by the US Dollar."

Euro Boost

Investors are purchasing from a short-term viewpoint, which is strengthening the euro and leading to better performance for European equities. This year, the Euro has appreciated roughly 4% relative to the U.S. dollar and nearly reached $1.10 earlier this month.

However, pushing further is quite challenging. Europe would need to surmount significant obstacles and conflicting national interests that have thwarted many efforts before.

A crucial aspect involves enhancing the unification of sizable yet disjointed debt markets, possibly through increased shared issuances that might serve as an alternate secure asset to US Treasury securities.

For several years, Macron has advocated for shared borrowing with the aim of achieving this objective, and more recently, to finance defense and technological expenditures.

We genuinely have an opportunity to establish a robust financial system built on trust within Europe, complete with prospects for secure European assets; however, this isn't happening immediately—it's more about future possibilities," explained Michala Marcussen, the chief economist at Societe Generale. "I don't believe we're poised to shift from a dollar-centric system to one centered around the euro.

--Assisted by James Regan, Naomi Tajitsu, Alice Gledhill, and Alexander Weber.

(Updates euro-dollar pricing.)

Additional tales of this nature can be found on GudangMovies21

©2025 GudangMovies21L.P.

Comments

Post a Comment