Map Shows Which U.S. States Offer the Best Bang for Your Retirement Buck with $1.5M

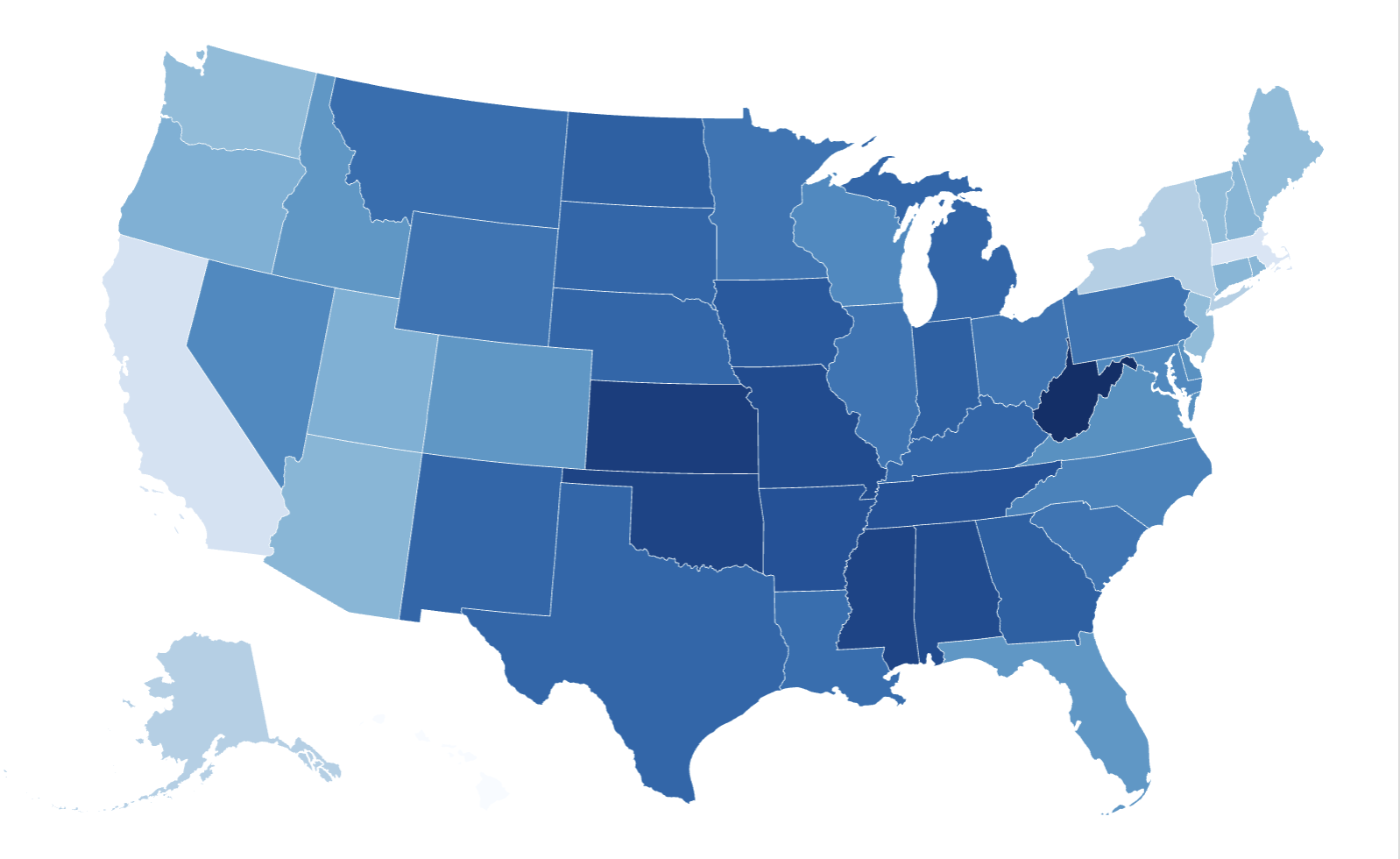

A majority of U.S. adults believe they need to save $1.46 million to retire comfortably according to a 2024 Northwestern Mutual survey —and a gudangmovies21 map shows where the pot would last the longest.

The map is derived from information in a recent study conducted by GOBankingRates This provides a state-by-state guide to the top spots for retirement, though the ideal savings target of $1.5 million far exceeds what most Americans manage to save.

Why It Matters

The population in the U.S. is getting notably older at an accelerated pace. It’s projected that by 2040, the count of Americans who are 65 years old and up will surpass twice their current number from the year 2000, hitting approximately 80 million people. Meanwhile, the group comprising individuals aged 85 and over could see their numbers almost triple during the same period when measured against 2000 figures.

As the nation prepares for what some call the "silver tsunami," driven largely by the Baby Boomers, the U.S. retirement framework faces significant pressure. The Social Security trust funds are projected to run out of money as early as 2035.

The advantage of increased longevity is accompanied by significant doubt about the sustainability of Social Security, the risk of rising prices, and potential economic disruptions that might jeopardize the financial stability of Americans.

Based on a 2024 report from the National Council on Aging (NCOA), 80 percent of Americans aged 65 and over faced financial difficulties at that time or were vulnerable to economic instability during their retirement years.

What To Know

GOBankingRates determined the duration for which a retiree might be able to survive financially with a retirement nest egg of $1.5 million along with their monthly Social Security income.

In Hawaii, Massachusetts, California, New York, and Alaska, the $1.5 million would be depleted most quickly; whereas in West Virginia, Kansas, Mississippi, Oklahoma, and Alabama, it could potentially endure for over 50 years.

Here is the duration that the total amount would support a retiree in each state, listed from longest to shortest, based on the yearly expenses beyond Social Security.

1. West Virginia

- The yearly expense for maintaining living standards post-Social Security totals $27,803.

- For how long will $1.5 million last: 54 years

2. Kansas

- Yearly expense for maintaining living standards post Social Security: $28,945

- How long will $1.5 million last: 52 years

3. Mississippi

- Yearly expenses following Social Security benefits amount to $29,426.

- For how long will $1.5 million last: 51_years

4. Oklahoma

- Yearly expense for living following Social Security benefits: $29,666

- For how long will $1.5 million last: 51 years

5. Alabama

- Yearly expense for living post Social Security: $30,207

- How long will $1.5 million along with Social Security benefits endure: 50

6. Missouri

- Yearly expenses post Social Security amount to $30,327.

- For how long will $1.5 million last: 50 years

7. Arkansas

- Yearly expense for maintaining lifestyle post Social Security: $30,327

- How long will $1.5 million last: 49 years?

8. Tennessee

- Yearly expenses post Social Security amount to $30,928.

- How long $1.5 million will last: 49_years

9. Iowa

- Yearly expenses post Social Security amount to $31,168.

- For how long will $1.5 million last: 48 years

10. Indiana

- The yearly expense for maintaining life post-Social Security stands at $31,709.

- How long $1.5 million will last: 47 years

11. Georgia

- Yearly expenses following Social Security benefits amount to $31,829.

- How long will $1.5 million last: 47years

12. North Dakota

- Yearly expense for maintaining lifestyle post Social Security: $32,190

- How long $1.5 million will last: 47 years

13. Michigan

- Yearly expenses post Social Security amount to $32,310.

- How many years $1.5 million will last: 46

14. South Dakota

- Annual cost of living after Social Security: $32,310

- How long will $1.5 million last: 46years

15. Texas

- Yearly expense for maintaining living standards post Social Security: $32,490

- How long will $1.5 million last: 46years

16. Nebraska

- Yearly expense for living post Social Security: $32,610

- How long can $1.5 million last: 46_years

17. Kentucky

- Yearly expense for living post Social Security: $32,670

- How long will $1.5 million last: 46-years

18. New Mexico

- Yearly expense for maintaining lifestyle post Social Security: $32,670

- How long will $1.5 million last: 46_years

19. Louisiana

- Yearly expenses following Social Security benefits amount to $33,031.

- How long will $1.5 million last: 45 years?

20. Montana

- Yearly expense for maintaining lifestyle post Social Security: $33,331

- In how many years $1.5 million will last: 45

21. Ohio

- Yearly expenses post Social Security amount to $33,872.

- How many years $1.5 million will last: 44

22. Pennsylvania

- Annual cost of living after Social Security: $33,872

- How long will $1.5 million last: 44

23. South Carolina

- Yearly expense for living post Social Security: $34,052

- How long will $1.5 million last: 44

24. Minnesota

- Yearly expenses following Social Security benefits amount to $34,113.

- How long will $1.5 million last: 44

25. Wyoming

- Yearly expense for living following Social Security benefits: $34,173

- How long $1.5 million will last: 44years

26. Illinois

- Yearly expense for living post Social Security: $34,233

- In how many years $1.5 million will last: 44

27. North Carolina

- Yearly expense for living post Social Security: $35,495

- In how many years $1.5 million will last: 42

28. Maryland

- Yearly expenses post Social Security amount to $36,276.

- In how many years $1.5 million will last: 41

29. Wisconsin

- Yearly expenses following Social Security benefits amount to $36,516.

- In how many years $1.5 million will last: 41

30. Nevada

- Yearly expense for maintaining lifestyle post Social Security: $36,997

- In how many years $1.5 million will last: 41

31. Delaware

- Yearly expense for living post Social Security: $37,057

- How long will $1.5 million last: 40 years?

32. Virginia

- Yearly expenses following Social Security benefits amount to $37,237.

- How long will $1.5 million last: 40 years?

33. Idaho

- Yearly expenses post Social Security amount to $38,138.

- How long can $1.5 million last: 39

34. Florida

- Yearly expenses post Social Security amount to $38,379.

- For how long can $1.5 million last: 39

35. Colorado

- The yearly expense for maintaining living standards post-Social Security amounts to $38,559.

- For how long will $1.5 million last: 39 years

36. Utah

- Yearly expense for living post Social Security: $42,645

- How many years $1.5 million will last: 35

37. Oregon

- Yearly expense for living post Social Security: $42,945

- How long will $1.5 million last: 35years

38. New Hampshire

- Yearly expenses post Social Security amount to $43,847.

- In how many years $1.5 million will last: 34

39. Connecticut

- Yearly expenses post Social Security amount to $43,967.

- How long will $1.5 million last: 34

40. Rhode Island

- Yearly expenses following Social Security benefits amount to $44,387.

- In how many years $1.5 million will last: 34

41. Arizona

- Yearly expenses post Social Security amount to $44,628.

- For how long can $1.5 million last: 34_years

42. Maine

- Yearly expense for living post Social Security: $45,048

- How long will $1.5 million last: 33 years

43. Washington

- Yearly expenses post Social Security amount to $45,108.

- For how long can $1.5 million last: 33

44. Vermont

- Yearly expenses following Social Security benefits amount to $45,409.

- For how long can $1.5 million last: 33

45. New Jersey

- Yearly expenses post Social Security amount to $45,829.

- How long can $1.5 million last: 33

46. Alaska

- Yearly expense for living post Social Security: $50,997

- How long will $1.5 million last: 29

47. New York

- Yearly expenses post Social Security amount to $50,997.

- How long will $1.5 million last: 29

48. California

- Yearly expense for living post Social Security: $63,795

- How long will $1.5 million last: 24 years

49. Massachusetts

- Yearly expense for maintaining lifestyle post Social Security: $65,117

- How long will $1.5 million last: 23 years

50. Hawaii

- The yearly expense for maintaining a lifestyle post-Social Security benefits totals $87,770.

- How long will $1.5 million last: 17_years

The information was gathered utilizing the nationwide mean yearly spending by individuals aged 65 and above, as detailed in the Bureau of Labor Statistics' Consumer Expenditure Survey from 2023, along with the annual Social Security earnings derived from the SSA’s data released in January 2025.

What's Next

Many Americans set aside significantly less than the $1.5 million deemed sufficient by GoBankingRates for their retirement savings.

According to a 2024 report from the Transamerica Center for Retirement Studies, as of late 2023, employees had accumulated approximately $64,000 in their combined household retirement funds. The data showed that Baby Boomers led with average savings of $194,000, followed by Generation X with $93,000, Millennials with $50,000, and Generation Z with $40,000.

The researchers noted with alarm that 32 percent of Generation X members and 26 percent of Baby Boomers possessed under $50,000 in their retirement accounts as they neared retirement age.

Related Articles

- Warren Buffett Is Making Large Bets on Japan

- Retail Sales Rebound Falls Short of Expectations, Dealing a Setback to President Trump

- Long-Term Advantages of Tariffs Outweigh Initial Expenses | Opinion

- Trump's Tariffs Might Decelerate the US Housing Sector in 2025

Start your unlimited gudangmovies21trial

Comments

Post a Comment