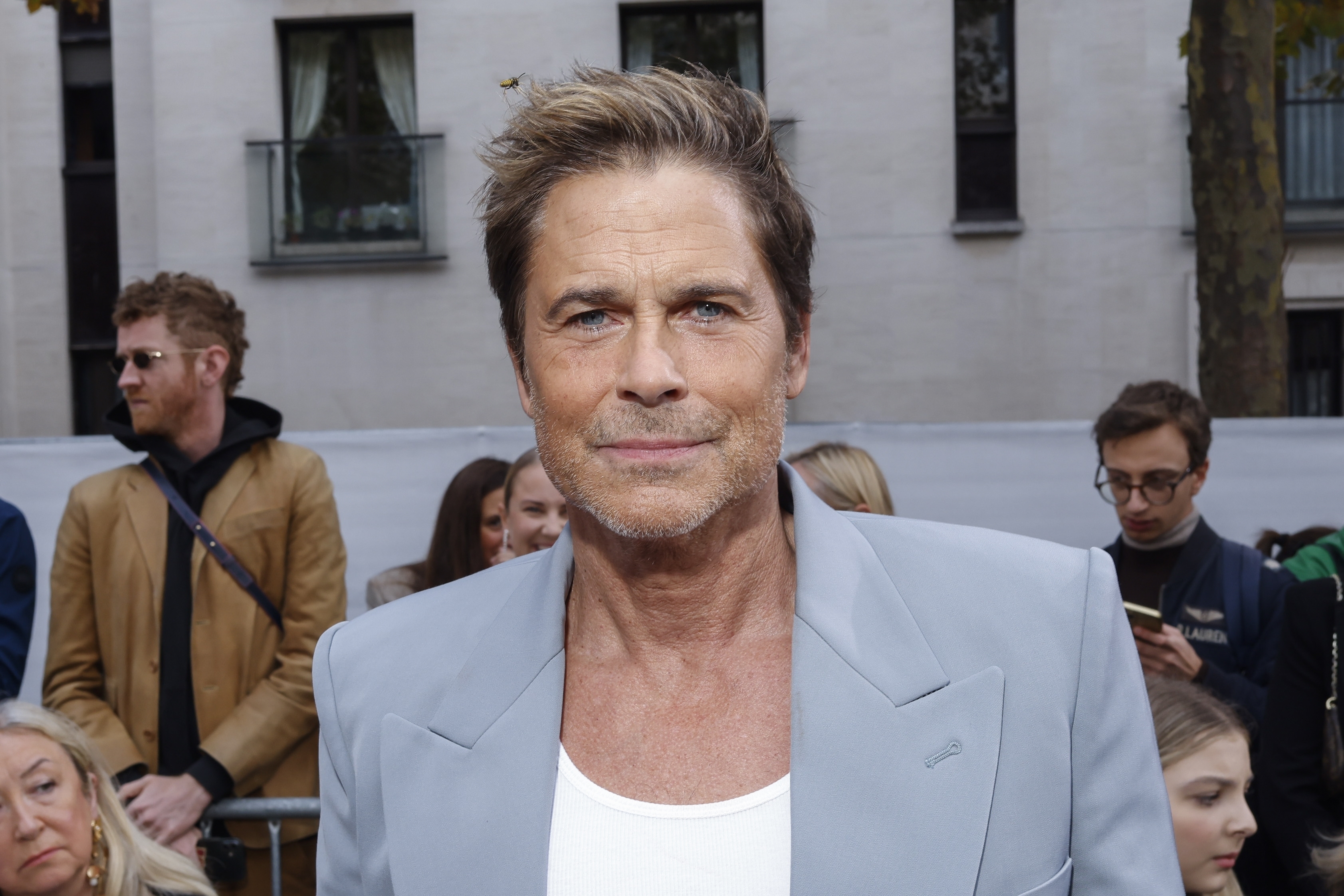

Rob Lowe Rips into California's Movie Tax Policies: "Everyone Responsible Should Be Fired"

Rob Lowe criticized California's meager film industry perks, telling actor Adam Scott during a recent episode of his podcast. Literally! With Rob Lowe , implying that "everyone should be let go."

gudangmovies21 Has reached out to Lowe's representative and the California Film Commission for comments through email.

Why It Matters

A number of states provide film production incentives such as tax breaks and subsidies aimed at drawing more productions and enhancing their local economies.

In addition to California, states like Georgia, Louisiana, New York, Illinois, and Massachusetts provide substantial incentives, and actor Matthew McConaughey has recently done so too. made a big push For Texas to boost its rewards.

Los Angeles, which houses Hollywood, was struck severely by destructive wildfires Earlier this year, delivering yet another setback to California's recovering film industry which has been grappling with prolonged difficulties. effects of COVID-19 and probably increasing additional production expenses.

What To Know

On the March 13 episode of his podcast, Lowe called out California’s film industry incentives, stating, “It costs less to gather a hundred U.S. citizens in Ireland than to cross the studio lot.” Fox , beyond the soundstages, and perform it there."

The Fox Studio Lot stands as one of Hollywood’s most recognizable production hubs, featuring 15 sound stages, post-production facilities, and numerous sets.

Scott, who starred in Parks and Recreation With Lowe, the actor inquired, "Do you believe that if we filmed?" Parks Right now, we could be in Budapest?

Lowe replied, "Absolutely, we would be there. We’d be in Budapest."

The 9-1-1: Lone Star The actor informed Scott that he recently declined a well-prepared series, complete with finished scripts and concluded agreements, due to it being scheduled to film in New York, which would have required him to move.

" filming has become prohibitively costly here," Scott commented about Los Angeles.

Lowe went on: "There are no tax incentives here. Other locations offer up to 40 percent—and more besides. This doesn’t include the benefits from unions either. The issue purely lies with the taxation policies. What’s going on in California and Los Angeles is outrageous. Everyone involved ought to lose their job over this."

The California Film Commission manages the state’s tax incentive scheme for movies and television shows. It provides an attractive 25% tax break for standalone productions along with moving TV series, whereas feature films, fresh TV series, pilot episodes, and mini-series qualify for a 20% reduction. This extensive initiative, named Film & TV Tax Credit Program 3.0, has allocated $1.55 billion overall, distributing around $330 million each year until its expiration date of June 30.

The new iteration of the credits initiative, known as Program 4.0, will commence on July 1, 2025, and conclude on June 30, 2030.

Other states have gained favor as hotspots for filmmaking due to their assorted financial perks, with several providing tax breaks nearly twice as generous as those offered by Hollywood.

What People Are Saying

In a news release dated March 19, California Governor Gavin Newsom stated. Although other states attempt to catch up with California’s cinematic achievements, it's widely recognized that the Golden State remains the epicenter of the global entertainment industry—a status achieved over many years of pioneering efforts and dedication. The current [funding] grants are crucial for maintaining this momentum, as they help sustain countless well-paid positions ‘behind the scenes’ and bolster the local enterprises that thrive thanks to an active film and TV sector.

In a "True to Texas" campaign video released in January, Matthew McConaughey stated his support. So what do you think, Texas Legislature? If you're not satisfied with what Hollywood has been serving up, let's step into the kitchen ourselves.

Colleen Bell, who leads the California Film Commission, stated in a March announcement. The severe wildfires in Southern California have posed unparalleled difficulties for our film and television sector, halting over a dozen productions under our Film & Television Tax Credit Program and affecting numerous others.

What Happens Next

At the beginning of this month, the California tax incentive scheme chose 51 movies for production within the state—the highest number ever accepted in one submission period. These film projects are projected to provide employment opportunities for roughly 6,500 actors and staff members along with hiring around 37,000 extras, contributing approximately $346.9 million towards salary expenses.

The movie sector in Texas is endeavoring to get significant tax breaks approved by the state’s legislative body.

Related Articles

- More Than Half of California's Shoreline Alerted About Hazardous Marine Environment

- The Death Penalty Makes a Comeback in Los Angeles

- Residents of Various California Locations Instructed to Keep Their Windows Shut

- California's Home Insurance Sector Confronts Fresh Challenge

Start your unlimited gudangmovies21trial

Comments

Post a Comment