S&P 500 Enters Correction: These 5 Undervalued Stocks Demand Attention Now

On March 13, the S&P 500 the stock finished the day 10% lower than its previous record peak. This officially marked the entry of the stock market into what's referred to as " correction "territory," despite being a misnomer. Who can definitively claim that the value of the S&P 500 today is more accurate than it was yesterday or will be tomorrow?

The fact that a 10% retracement is termed a market correction isn’t crucial. Two other points hold greater significance. Firstly, market corrections occur approximately every few years — this is part of the norm. Secondly, these corrections historically present an opportune moment to purchase quality company stocks at reduced prices.

Where should you put your $1,000 investment at this moment? Our analysis group has just disclosed their insights into what they consider to be the top choices. 10 best stocks to buy right now. Learn More »

When I survey the stock market, I sense that there are more purchasing prospects than usual, which makes it straightforward for me to compile a roster of five stocks that seem exceptionally undervalued. The selection process was so bountiful that I could easily extend my list further. However, for this discussion, I aim to underscore some specific reasons behind these choices. Lyft (NASDAQ: LYFT) , Shift4 Payments (NYSE: FOUR) , Comfort Systems USA (NYSE: FIX) , Crocs (NASDAQ: CROX) , and Airbnb (NASDAQ: ABNB) All of these could be advantageous stocks to purchase today.

1. Lyft

Lyft stock has dropped more than 40% from its 52-week high as a result of widespread concerns about its ability to compete in the ride-sharing sector. However, the firm’s performance data paints a different picture. By the end of 2024, it reported record-high quarterly active users totaling 24.7 million and reached an all-time peak of almost 219 million rides during the quarter, marking a rise of 15% compared to the previous year.

The significant uptake led to unprecedented financial outcomes for Lyft as well. The major advancement lies in the company’s performance over the entire year. free cash flow , which saw its first positive figure of $766 million in 2024. This indicates that Lyft stock is trading at an impressively low multiple of just 6 multiply its free cash flow as of my last update.

It’s too inexpensive to overlook since Lyft anticipates expanding its revenue in 2025 and improving profit margins, partly due to advancements in their ad business. Essentially, Lyft stock looks appealing with record-high usage, low share prices, and an expectation of substantial improvement for the company moving into 2025.

2. Shift4 Payments

On December 4th, President Donald Trump selected Jared Isaacman, the founder and CEO of Shift4, to lead NASA. Following this nomination, Shift4’s stock has dropped by 15%, which represents a total decline of 33% since reaching peak levels in 2025. This shift in management has caused investors considerable concern regarding the future direction of the firm. Additionally, recent news concerning an ambitious $1.5 billion purchase of a duty-free retail network did not excite financial experts either. Global Blue .

These concerns appear exaggerated. Shift4 is increasingly recognized as a significant player in the financial services sector, highlighted by its expanding payment volumes. During the last quarter of 2024, the firm processed total payment flows exceeding $48 billion — this figure is roughly sevenfold compared to what was seen in the corresponding period in 2020. To put it simply, Shift4’s platform handles more transactions now than at any point previously, underscoring its critical role for clients.

In 2025, Shift4 anticipates a top-line expansion exceeding 20%, indicating robust development for any enterprise. Additionally, the firm maintains consistent profitability. net income of nearly $300 million in 2024. This means that it trades at its cheapest price-to-earnings (P/E) ratio ever at 28. Considering its torrid growth rate, that's a great price at which to buy shares for the long haul.

3. Comfort Systems USA

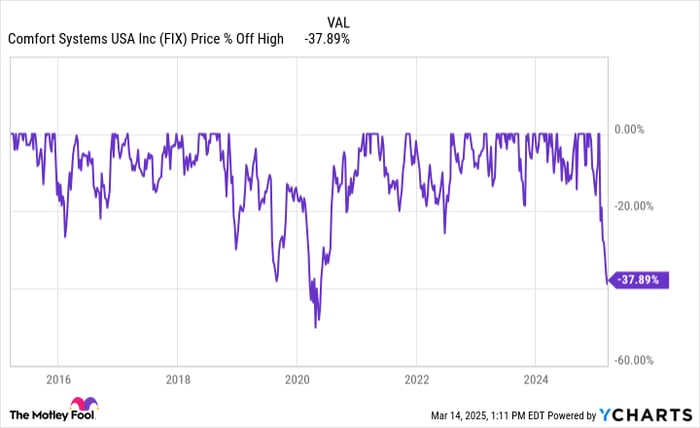

In the last ten years, hardly any stocks have performed as well as Comfort Systems — it has surged almost 1,700%. However, it’s currently down by about 40% from its peak, which represents its second-largest decline this decade. To put it simply, such an opportunity doesn’t come around often; right now might be one of those rare occasions when you can get a good deal on this stock. this monster stock shouldn't go to waste.

Investing in Comfort Systems presents a unique chance to back an established yet seemingly mundane enterprise poised for significant expansion due to substantial long-term growth trends. Among their various offerings, the firm’s electrical systems play a crucial role in sectors like data center operations and semiconductor fabrication facilities. With the surge in demand driven by advancements in AI technology, numerous new projects are being initiated to cater to these requirements, thus ensuring a rapidly increasing pipeline of work for Comfort Systems.

By the fourth quarter of 2024, Comfort Systems reported a backlog totaling $6 billion, marking an increase of approximately 16% compared to the previous year and rising by 50% since the conclusion of 2022. The global AI data center market is anticipated to expand at an almost 26% yearly pace until 2032, as per Fortune Business Insights projections, which suggests significant potential for growth for both Comfort Systems USA and its investors over the next ten years. Currently trading at merely 23 times earnings, this makes the stock quite attractive considering the prospects ahead.

4. Crocs

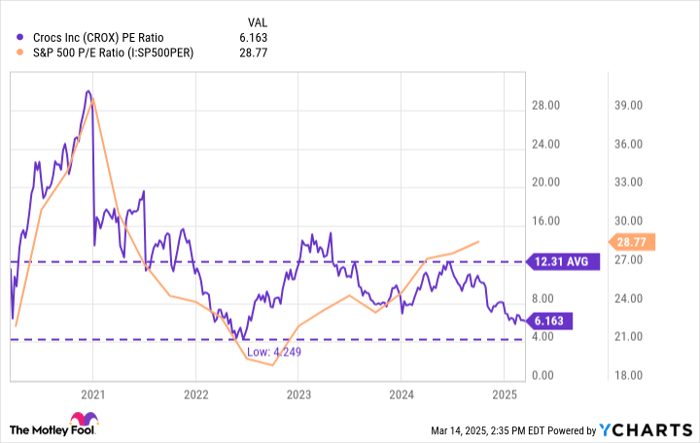

When viewed from an earnings valuation standpoint, Crocs stock stands out as the most affordable option on this list, with a price-to-earnings ratio of only 6. In contrast, the S&P 500 is significantly pricier, coming in at approximately 29 times its earnings, based on data from YCharts. It should be noted, shoe stocks For instance, Crocs typically has low stock valuations. However, as shown in the chart below, Crocs is currently trading at roughly half of its five-year average valuation.

Certainly, Crocs stock may not align well with growth investors since their revenue increased by just 3.5% from 2023 to 2024, and company leadership anticipates roughly a 2% expansion in 2025. Nonetheless, the enterprise remains consistently profitable when adjusting for specific metrics. operating margin Of 25% last year and an anticipated 24% margin this year. This provides ample funds for returning to shareholders.

Currently, Crocs' management has been granted the authority to buy back $1.3 billion worth of its stock — more than 20% of the shares outstanding — which might increase shareholder value in a hurry. Moreover, it repaid over $300 million in debt in 2024 and could continue reducing it in 2025. In other words, it might not grow the top line by much. But management will be using its hefty profits for the benefit of investors.

5. Airbnb

Finally, Airbnb stock Reached a peak around 2021 and has since dropped by over 40%, despite being more than four years past that point. However, I believe this enterprise is of such superior quality and possesses so much potential that it won’t remain stagnant for long.

In spite of persistent negative outlooks concerning acceptance on its platform, Airbnb keeps reaching new highs. The firm currently boasts more than 8 million active listings alongside 5 million hosts. Coupled with robust traveler demand, this enabled the company to achieve record-breaking revenues of $11.1 billion in 2024—a rise of 12% compared to the previous year.

Apart from breaking records with its revenue, Airbnb also managed to generate $4.5 billion in free cash flow, boasting an impressive 40% margin. This makes the situation quite intriguing. Based on present tendencies, company leaders anticipate growth rates to fall within the low single digits during the coming first quarter. However, owing to robust free cash flow, they plan to allocate between $200 million and $250 million towards launching fresh ventures later in the year.

To put it differently, Airbnb’s main operation is robust, expanding, and the share price is low. However, the firm is simultaneously preparing for its subsequent stage of development. a point that I think many investors are overlooking .

I’ve chosen these five stocks purposefully. Each one is currently undervalued due partly to the recent stock market downturn, making them potential candidates for a well-rounded portfolio. For instance, Lyft and Comfort Systems offer access to significant growth areas like ride-sharing and artificial intelligence. Meanwhile, Crocs provides stability with its straightforward footwear sector, unlike Shift4, which operates in the highly competitive fintech industry. Lastly, Airbnb presents unexplored possibilities through innovative ventures being introduced this year and into the future.

That's why I won't disclose which one among these five stocks I favor most at present. Actually, I have an appreciation for each of them. Collectively, I am confident that their performance will surpass the broader market for those with a long-term investment horizon.

Don't let this second chance for a possibly profitable opportunity slip away.

Have you ever felt like you've missed out on investing in some of the most profitable stocks? If so, you should definitely listen to this.

From time to time, our skilled group of analysts releases a “Double Down” stock Here's a suggestion for firms that seem poised for growth. Should you fear missing out on potential gains, this might be an ideal moment to purchase shares prior to their inevitable rise. The data clearly supports this strategy:

- Nvidia: If you had invested $1,000 when we increased our stake in 2009, you’d have $315,521 !*

- Apple: If you had invested $1,000 when we increased our stake in 2008, you’d have $40,476 !*

- Netflix: If you had put in $1,000 when we increased our investment in 2004, you’d have $495,070 !*

Currently, we're sending out "Double Down" alerts for three amazing companies, and such an opportunity might not come around again anytime soon.

Continue »

*Stock Advisor returns as of March 14, 2025

Jon Quast holds stakes in Airbnb, Crocs, Lyft, and Shift4 Payments. The Motley Fool owns shares of and advocates for investing in Airbnb and Shift4 Payments. They also recommend purchasing stock in Crocs. Additionally, The Motley Fool has a disclosure policy .

Comments

Post a Comment