Tesla Stock Sinks as Another Company Flags Elon Musk's Sales Struggles

Topline

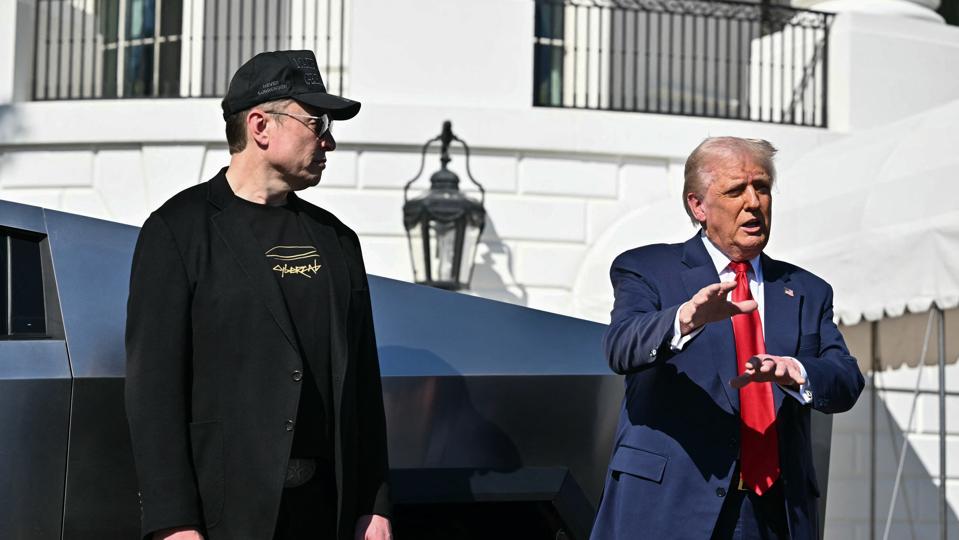

Tesla's stock declined further on Monday despite the overall market shedding its correction status, with the company’s shares—led by the globe’s wealthiest individual, Elon Musk—experiencing pressure. further pressure From Wall Street as Musk becomes increasingly intertwined with the White House.

Key Facts

Tesla shares fell approximately 5% to reach $238 each by the latter part of Monday, marking a disappointing beginning to the week following its closing price on Friday. lowest end-of-week level from the week prior to the election.

Tesla's decline occurred amid an overall upturn, with the S&P 500 rising by 1%, following its 2.1% increase from the previous day and poised for its best closing point in ten days.

According to FactSet data, Tesla was the lowest-performing stock among approximately 100 S&P stocks with a valuation of $100 billion or more on Monday.

The decline occurred as Musk’s company encountered further challenges another ding from Wall Street analysts.

In a Sunday update sent to clients, Mizuho analysts headed by Vijay Rakesh reduced their price objective for Tesla stock by $85 down to an optimistic $430. They also revised their 2025 vehicle delivery prediction from 2.3 million units to 1.8 million—a reduction exceeding 20%, which significantly underestimates the average analyst expectation of around 2 million deliveries.

Rakesh chalked up Tesla’s “sales woes” leading to a decline in "brand perception" both in the U.S. and the European Union, along with worsening geopolitical conditions and growing competitive pressure from local electric vehicle companies in China.

Surprising Fact

According to Mizuho analysts, Tesla experienced a 2% decline in U.S. sales compared to the previous year when overall electric vehicle (EV) sales in America increased by 16%. In China, Tesla saw a dramatic drop of 49% in sales despite an 85% growth surge within the EV sector. Additionally, their German sales plummeted by 76%, even though the local EV market expanded by 31% in Europe.

Key Background

Tesla shares have dropped 41% this year, marking the second-largest decline among companies included in the S&P index. Following suit were financial giants like Mizuho, Goldman Sachs, JPMorgan, and UBS, all revising their predictions for Tesla’s deliveries downward. "It's challenging to find an equivalent situation in automotive history where a brand has experienced such rapid devaluation," observed JPMorgan analysts last week. They highlighted how Tesla's reputation has recently taken significant hits, particularly in regions where Musk became entangled with conservative political discourse, such as Germany. Despite being close allies politically, Musk faces setbacks due to former President Donald Trump's aggressive tariff policies, which negatively impact his primary asset: Tesla. letter submitted to the Office of the United States Trade Representative last Tuesday, Tesla lobbied The Trump administration aimed to adopt a "gradual strategy" regarding tariffs and assessed that Tesla's electric vehicles include "specific parts and components" that are "hard or impossible to obtain domestically." This stance contrasted with President Trump’s often changing tariff schedules and objectives. About 53% Participants in a CNN survey released last week indicated that their perception of Musk leans more towards the unfavorable side, as opposed to approximately 35% who have a favorable impression and around 11% who remain indifferent.

Contra

The Tesla share price has risen by 7% since last Monday. suffered A 4.5-year low of 15% occurred amidst a widespread sell-off connected to worries about economic uncertainties due to Trump’s tariffs.

gudangmovies21Valuation

Musk’s $329 billion net worth renders him effortlessly the wealthiest individual on Earth, although that’s down more That's over $130 billion less than its high of $464 billion recorded in December, when Tesla's stock reached around $480 after an election-related surge.

Further Reading

Comments

Post a Comment