These 5 Books Helped Me Retire from Tech at 59

- Alvaro Munevar Jr. stepped down at the age of 59 following the development of a secondary venture in real estate.

- Going through literature on business and personal finances assisted him in getting ready for an earlier retirement.

- The books provided him with knowledge about tactics such as holding index funds and recognizing when to stop.

I retired from my tech career In 2024, at the age of 59, following more than three decades of work.

The key ingredient to my success is early retirement remained in mid-level management roles, maintaining manageable working hours.

I used my spare time to learn how to become financially secure I immersed myself in acquiring knowledge about financial management by perusing various personal finance literature.

Drawing from my study, I constructed a real estate side business This gave me the extra earnings required to ultimately quit my employment.

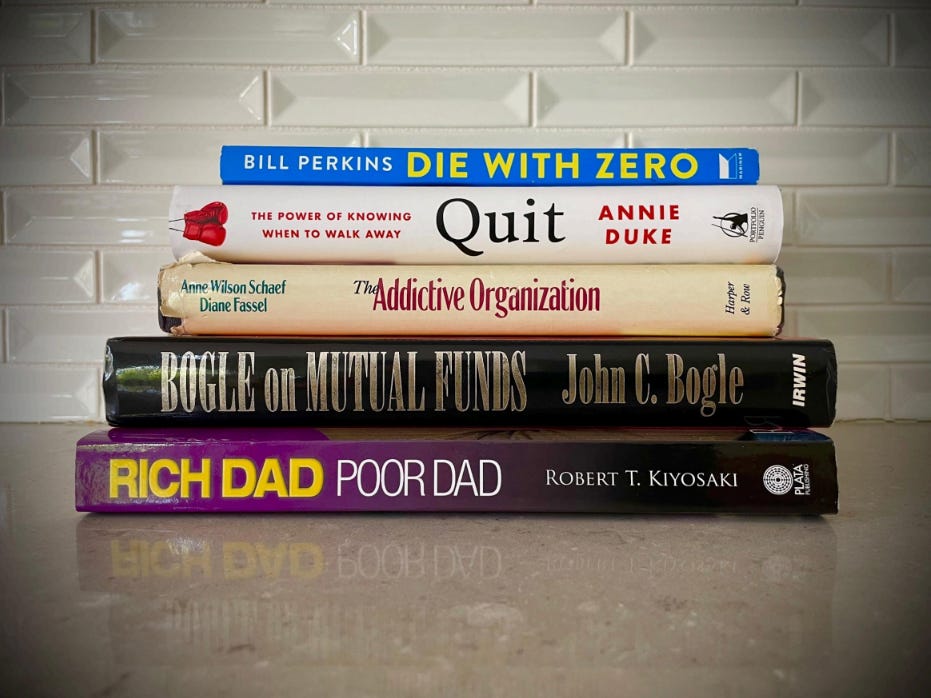

The following five essential books significantly aided me throughout my journey: retiring early .

1. "Rich Dad Poor Dad" by Robert Kiyosaki

The 1997 book by Robert Kiyosaki showed me a new way to approach my finances.

Kiyosaki, a personal finance author, shares the tale of his father—the 'poor dad,' an educator with modest resources who adhered to conventional financial principles.

At the same time, the author's affluent mentor, known as the 'rich dad,' possessed various enterprises and imparted to Kiyosaki a more sophisticated strategy for amassing wealth via business ventures.

I found Kiyosaki's definition of assets As assets that fill your wallet such as shares or rent-producing real estate, and liabilities as expenses that empty your wallet like auto loans and apparel purchases, this distinction proves quite beneficial.

This book enabled me to grasp the effect of my buying choices and stressed the significance of acquiring rental properties as assets capable of generating extra income passively.

2. "Bogle on Mutual Funds" by John C. Bogle.

The 1993 publication by John C. Bogle, the creator of the investment advisory firm The Vanguard Group and the individual behind the widespread adoption of index funds, provided me with valuable insights into managing my finances.

The book supports owning broad market low-cost index funds , which monitor the performance of market indices such as the S&P 500, rather than the pricier actively managed mutual funds that include fund managers purchasing and trading financial instruments within your portfolio.

Once I understood that most actively managed funds fail to meet and exceed the returns of the S&P 500 over long periods of time, I converted the actively managed funds in my portfolio over to low-cost index funds that Bogle had recommended.

Certainly, choosing stocks with the aim of outperforming the market is thrilling, similar to gambling; however, only a small number of individual investors manage to achieve this consistently over time.

3. "The Addictive Organization" by Anne Wilson Schaef and Diane Fassel

"The Addictive Organization" offers a compelling viewpoint on potential pitfalls within the business sphere, authored by Anne Wilson-Schaef, a clinical psychologist, and Diane Fassel, a management consultant during the 1980s.

The book highlights how certain organizations may exhibit detrimental practices within their workplace environment that mirror individual addictions. These companies could be dismissing issues related to immoral conduct or encouraging an excessive focus on output that exhausts staff members.

The authors propose that such addictive management styles foster leaders who exert greater control over their staff and cultivate an environment characterized by fear.

Going through the examples in this book decreased my enthusiasm for climbing the corporate career ladder and intensified my urge to launch my own venture alongside my current employment.

4. "Exit: The Strength of Understanding When to Leave" by Annie Duke

Annie Duke’s 2022 publication served as a jolt of reality, intensifying my wish to exit the corporate world and head into retirement.

Duke is a past pro at playing poker professionally and has a history in cognitive psychology. In her book, she delves into being strategically minded about knowing when to walk away from something, emphasizing particularly on recognizing the right moments for cessation.

In the introduction, Duke talks about Muhammad Ali’s subsequent boxing career, mentioning how he kept competing even as his age advanced and seemingly never understood when to stop fighting.

This book made me realize that dedicating additional time to a profession which had grown less stimulating and engaging was not wise. Additionally, I grasped that staying in one place for too long could cause you to miss out on new chances.

5. "Die with Zero" by Bill Perkins

The book that led me through the last phase of my retirement was "Die with Zero," published in 2020, written by Bill Perkins, who is a hedge fund manager, entrepreneur, and poker player.

This assisted me in grasping the true value of money. In the piece, Perkins cautions us that as we age, we possess less time and vigor to relish our wealth.

The worth of money varies as you get older. In your youth, having $1 million or even $10 million carries significant value. It allows for travels, discovering new destinations, pursuing interests, and enjoying moments with loved ones when you are still full of vigor and energy.

$1 to $10 million isn’t worth the same to you when you're 85 years old compared to when you were younger. Despite being reasonably fit later in life, you might not be capable of participating in the energetic and dynamic pursuits anymore.

This book taught me that my money holds more significance for me now compared to when I reach my 70s or 80s. It inspired me to relish my prosperity sooner rather than later.

Literature assisted me in learning about individual financial management.

I would attribute these books for assisting me in mastering personal finances And plan to retire before I reach 60. These works have been published over several decades, yet I feel that their insights remain just as valuable now as when they were first penned.

Through these readings, I discovered the proper movement of my finances, developed an investment approach, and understood the importance of not being trapped in a corporate position indefinitely.

If you liked this tale, make sure to follow Business Insider on MSN.

Comments

Post a Comment