US Chip Grants in Limbo as Lutnick Pushes Bigger Investments

(GudangMovies21) -- Commerce Secretary Howard Lutnick indicated he might hold back promised Chips Act grants as he encourages companies seeking federal semiconductor subsidies to significantly increase their U.S.-based initiatives, said eight individuals acquainted with the situation.

The head of commerce aims for companies that received accolades under the 2022 Chips and Science Act to emulate Taiwan Semiconductor Manufacturing Co., following their recent announcement about expanding operations. invest another $100 billion In the U.S., this new commitment comes atop an earlier pledge of $65 billion, according to sources. The aim for Lutnick is to secure tens of billions more in additional investments in semiconductors, all without expanding the scale of federal grants, noted these individuals, speaking anonymously due to confidential discussions.

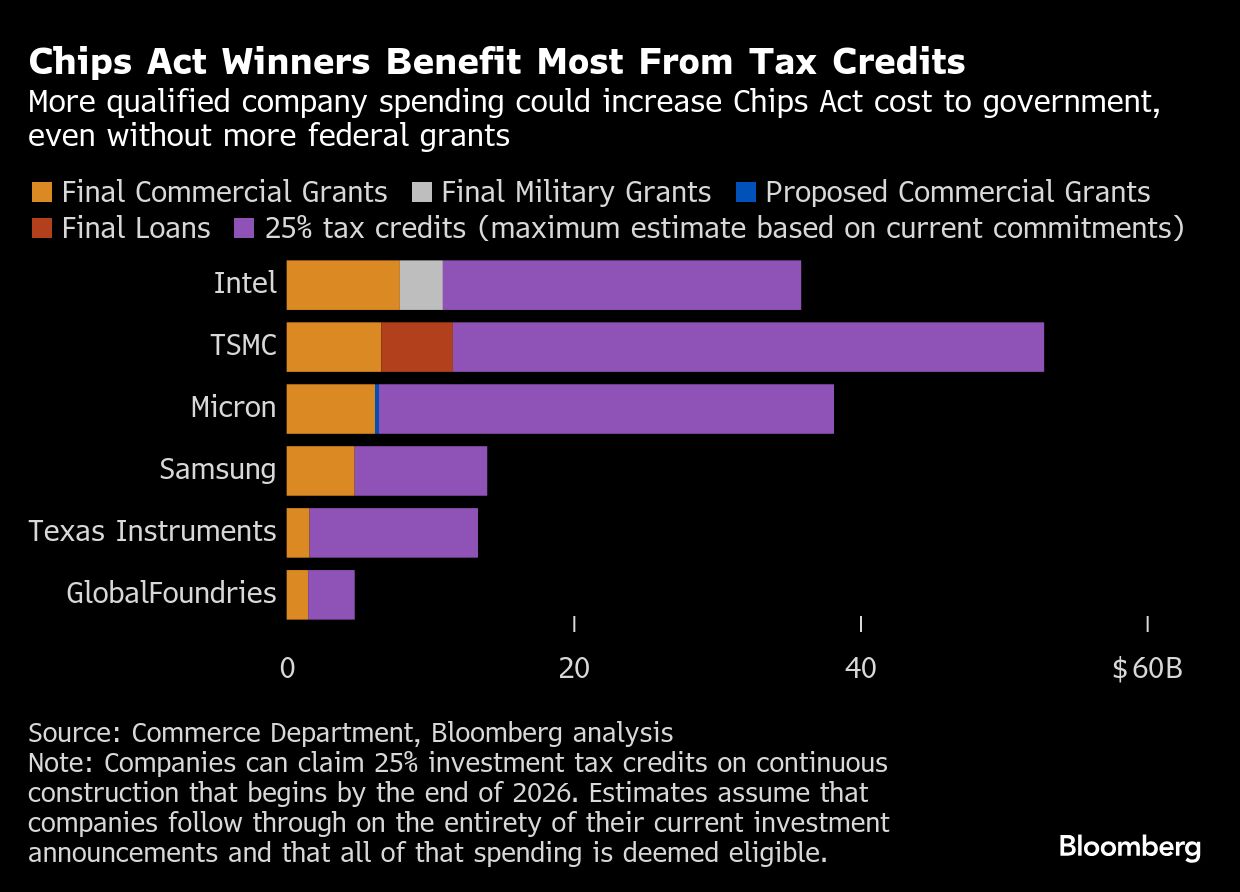

While negotiating, Lutnick’s group proposed that he might cancel previously approved subsidy payouts, according to several sources. Additionally, Lutnick showed interest in increasing a distinct 25% tax break under the Chips Act, these individuals mentioned. This incentive generally holds greater value for most businesses compared to the straightforward financial grants. Significant modifications to this tax credit would necessitate legislative action through Congress.

The Commerce Department did not reply to requests for commentary.

Tune into the "Here’s Why" podcast. Apple , Spotify or anywhere you listen

Lutnick has earlier mentioned his plan to examine Chips Act grants with the aim of obtaining what he refers to as the “benefit of the bargain.” President Donald Trump — who has urged lawmakers to abolish the legislation — did so again on Monday. signed an executive order focused Partly due to "securing more advantageous Chips Act deals compared to the prior administration."

The directive created a fresh department inside the Department of Commerce with the aim of motivating businesses to invest heavily in the U.S. This initiative, known as the United States Investment Accelerator, will streamline initiatives exceeding $1 billion and manage subsidies for semiconductors, according to the White House.

"This rebranding provides the president with a framework to endorse the underlying policy even though he had previously criticized the Chips Act," stated Jim Secreto, who formerly acted as the deputy chief of staff for ex-President Joe Biden's commerce secretary.

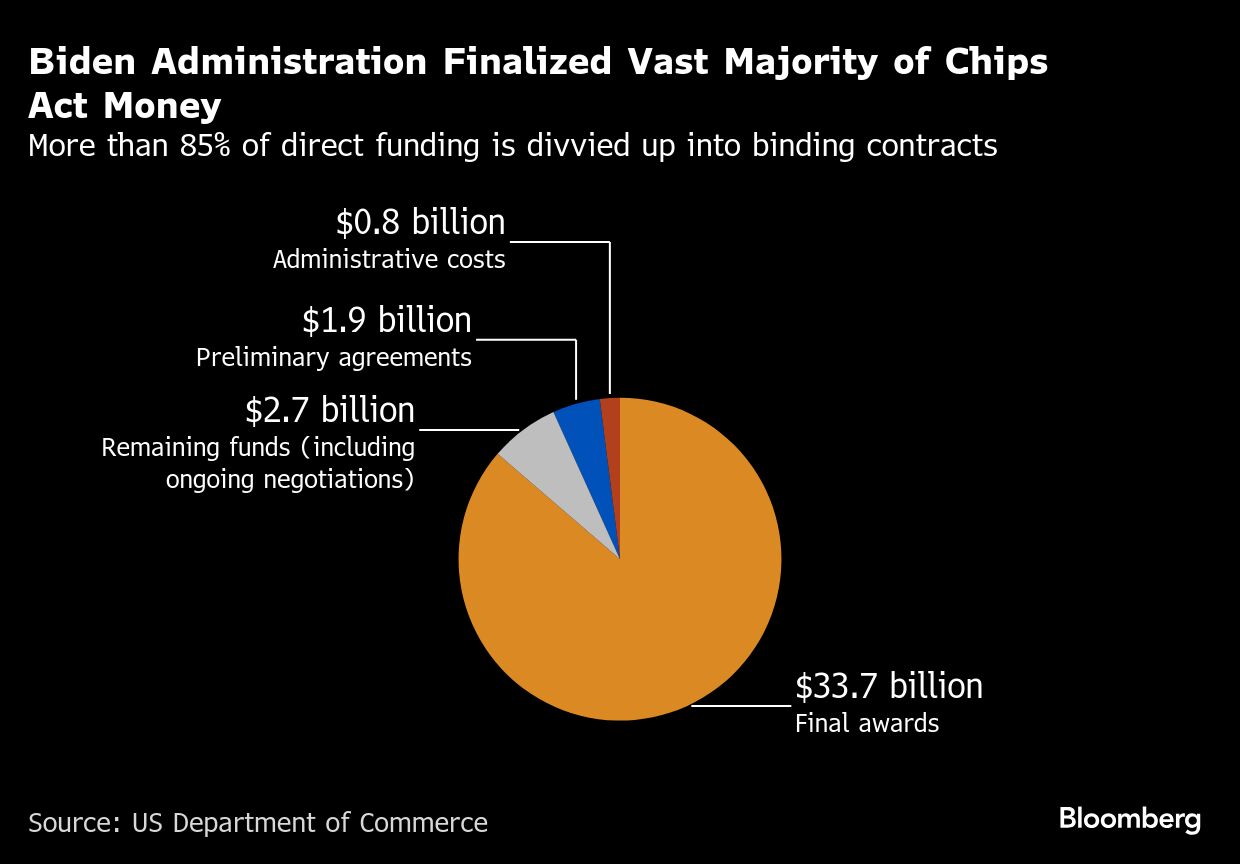

A new law with support from both parties has allocated $52 billion to rejuvenate the U.S. semiconductor sector following years of manufacturing moving to Asia. Most of this money will go directly to businesses through reimbursement grants for their private spending. These funds are intended to be released gradually as predetermined goals under each project are achieved.

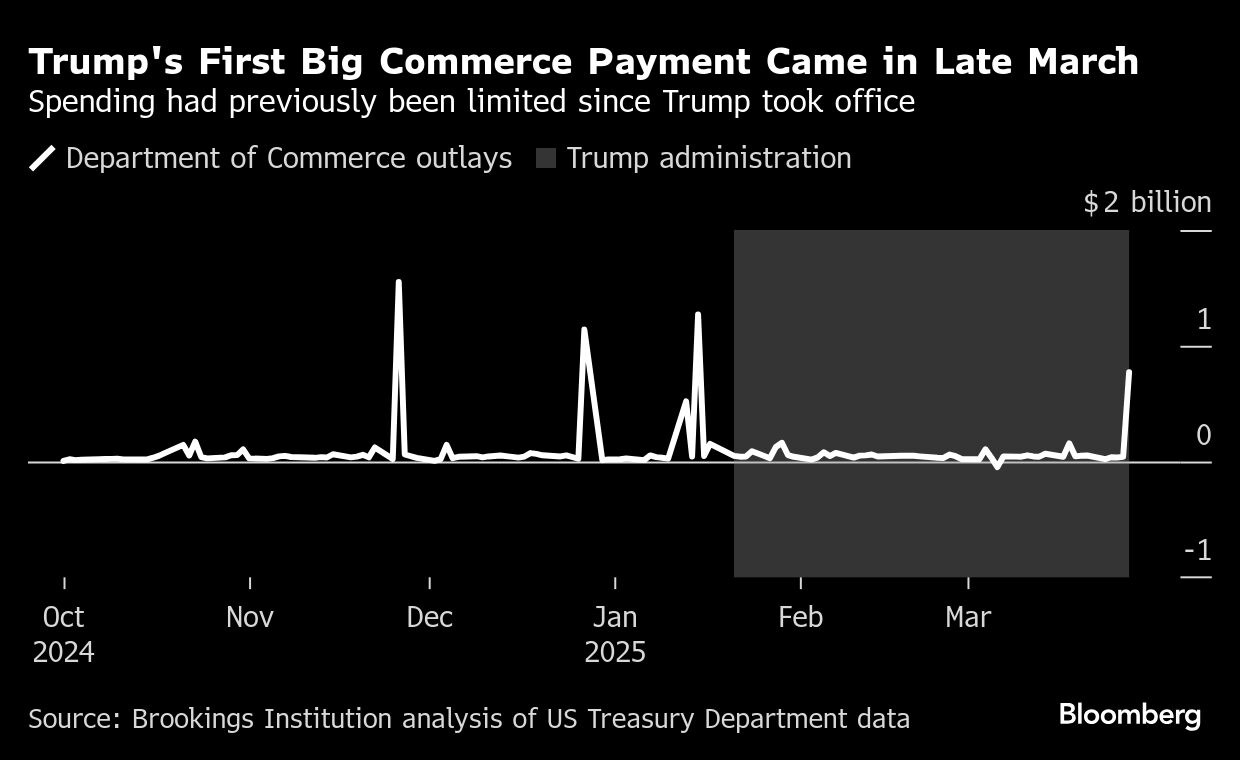

A number of businesses have not achieved any fresh milestones since President Trump assumed office, implying that they do not anticipate receiving funds from the new government just yet. However, indications suggest that Mr. Lutnick’s group is delaying the forthcoming distribution of this financial support as he scrutinizes the award pacts.

Learn more about the Chips Act during the Trump administration:| Trump Calls for End to $52 Billion Chips Act Subsidy Program US Chips Act Office Suffers Loss of 40% of Workforce Due to Trump-Era Shake-Up Lutnick Commits to Reviewing Chips Act, Avoids Comment on Contract Obligations Biden Transfers Control of $52 Billion Chip Initiative to Cautious Trump What's at Risk as Trump Seeks to Revoke the Chips Act: QuickTake |

In an instance, a smaller company which entered into a binding agreement under the Chips Act was finalizing negotiations regarding payment schedules prior to Trump taking office, according to several individuals. However, these discussions have been put on hold, making it uncertain as to when the funds will be released.

Several companies have struck initial deals under the Biden administration but haven't finalized their agreements and remain uncertain regarding when—or even if—they will secure funding. Among these firms is North Carolina-based Wolfspeed Inc., which mentioned last week that its $750 million agreement is still pending. likely to evolve However, they did not offer additional details, as reported by the Triangle Business Journal.

Shares of Wolfspeed dropped by 2% during the early morning trade on Tuesday. Meanwhile, Intel Corp., which has been facing challenges as a U.S. chip manufacturer, saw its stock fall by 1.6%.

Meanwhile, TSMC reached a significant threshold in late February that triggered a disbursal of $750 million from its broader Chips Act funding, according to sources close to the situation. It’s uncertain what the current standing of this payment is, as it was initially anticipated for early March. When asked about receiving these funds, a representative from TSMC chose not to provide any comments.

Federal spending data indicates that Commerce Department spending remained fairly steady under President Trump’s tenure until a significant disbursement of approximately $770 million occurred recently.

Biden’s team doled out Around $4.3 billion in Chips Act funding was allocated, with numerous preliminary and final awards announced prior to the departure of the current official. This flurry of agreements marked a significant move from the preceding administration. hoped would restrict interruptions to the program after Trump assumed control.

The primary recipients under this act encompass TSMC, Intel, Micron Technology Inc., Samsung Electronics Co., GlobalFoundries Inc., and Texas Instruments Inc., each set to obtain over $1 billion in subsidies. Collectively, these firms represent the bulk of the over $400 billion in committed private sector funding that the CHIPS Act has triggered.

However, Trump, who believes that tariffs serve as stronger motivation for businesses to construct manufacturing plants within U.S. borders, seeks for Congress to discontinue this program. unlikely prospect received considerable support from both parties in Congress.

Trump and Lutnick both credited the threat of tariffs on foreign-made chips with TSMC’s decision to expand from three to six plants in Arizona, plus other investments in chip packaging and research. TSMC, though, has said its latest investment is in accordance with U.S. market demands .

Trump is set to reveal new tariffs aimed at other nations on April 2, and he’s teased Duties on potato chips "in the future." It remains unclear whether businesses will address these risks by declaring additional investments.

Last year, Samsung reduced the scale of its intended investment in Texas, resulting in smaller The Chips Act funding exceeded initial expectations. Consequently, the firm’s semiconductor unit has benefited as a result. struggled in recent months as it loses ground to rivals. Samsung representatives declined to comment.

Meanwhile, Micron initially planned up to four sites in New York, but did so last year. began slow-walking plans For the third project, as it communicated with Japanese authorities regarding the establishment of a comparable facility there, Micron has made this known publicly. committed For the initial two locations in New York along with an additional facility in Idaho, all of these sites are included under its Chips Act grant. Micron chose not to comment.

Thomas Caulfield — who serves as the executive chairman at GlobalFoundries, having formerly held the position of CEO — has said those tariffs alongside Chips Act subsidies and a 25% investment tax credit Additionally, the program might "generate the momentum to encourage demand to return."

In nearly every instance, the Chips Act grants represent the smaller portion of company benefits compared to the subsidies they'll receive. A significantly larger amount of funding originates from the 25% tax credits, which similarly do not hinge upon environmental or labor criteria that Republicans have frequently contended shouldn't factor into the grant submission process.

Lutnick has expressed openness to broadening the tax credit, according to individuals acquainted with the situation, though he hasn’t provided any concrete details as of yet.

The present guidelines permit businesses to qualify for the credit on initiatives such as chip and wafer manufacturing, provided they commence construction by the end of 2026. A cross-party coalition of legislators has presented legislation. bill This would broaden the credit scope to include semiconductor research and development along with production. It would further offer these incentives to initiatives that commence construction by the close of 2036—providing businesses an additional ten years to initiate their projects.

“Credit is crucial,” stated Peter Cleveland, who serves as a senior vice president at TSMC, during an event. event Last week, he stated that advancing the U.S. semiconductor sector relies on ongoing cooperation with this administration and those that follow. He emphasized that such collaboration ought to continue via theextension of credits within the tax code.

There isn't any legal limit on how much corporations can claim, which means that expanding this could have substantial financial consequences. The Peterson Institute for International Economics remains unchanged on this point. estimated In June 2024, the credit might lead to approximately $85 billion in lost revenue — surpassing the initial estimate by the Congressional Budget Office by over triple. This increase stems from the substantial investments encouraged by the legislation.

--Assisted by Yoolim Lee, Jane Lanhee Lee, and Dina Bass.

(Includes semiconductor stock share information in the twelfth paragraph)

Most Read from GudangMovies21

- What Frank Lloyd Wright Discovered in the Desert

- The Rush for Gold Is Back in the Historical New Zealand Mining Town

- Bank regulators compete for workspace as OCC relocates back to New York tower.

- London Overcomes Last Obstacle for Additional High-Speed Rail Services to Europe

©2025 GudangMovies21L.P.

Comments

Post a Comment